- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

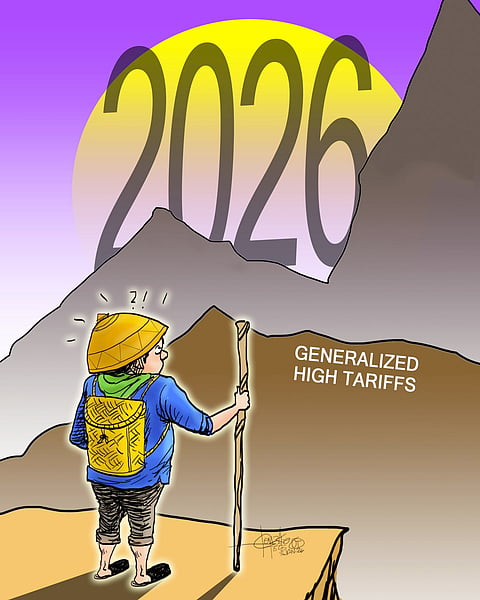

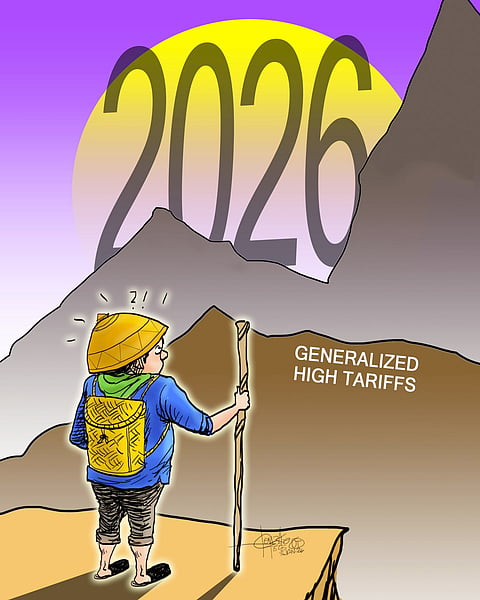

The year 2026 presents the Philippine economy with a complex tapestry of external opportunities and profound internal challenges. Observers see the nation’s trajectory shaped by the interplay of fragile global trade dynamics, shifting monetary policies, and, most critically, domestic political and fiscal headwinds that threaten to undermine its growth potential.

On the international front, the Philippines operates within an ASEAN context marked by persistent US tariff policies.

While the generalized high tariffs on the region remain a structural dampener on trade, the country benefits from crucial sectoral exemptions, particularly in semiconductors and electronics.

This niche has been a historical pillar of Philippine exports and will continue to provide a buffer, anchoring the nation within resilient global tech supply chains.

Furthermore, the limited US tariff rollback on food items offers a modest uplift for agricultural exports. As ING’s Deepali Bhargava notes, the Philippines stands to gain positive spillovers, though less than Indonesia, given its meaningful exposure to this sector.

However, this external landscape is precarious. The ever-present risk of a re-escalation of the US-China trade war, as highlighted by Maybank, poses a significant threat.

Such an event would send disruptive ripples through the very Asian manufacturing and tech networks that the Philippines relies upon, turning a current strength into a vulnerability overnight.

Monetary policy offers a potential tailwind. With the US Federal Reserve expected to embark on a rate-cutting cycle, the Bangko Sentral ng Pilipinas is projected to follow suit, with analysts like those at Maybank anticipating cuts up to 75 basis points.

This easing cycle aims to stimulate investment and consumption, providing much-needed liquidity to the economy. Nevertheless, the effectiveness of these measures is not guaranteed if they are not met with robust complementary actions on the fiscal and political fronts.

Herein lies the crux of the Philippine dilemma for 2026. As Deutsche Bank economists Vaninder Singh and Joey Chung starkly warn, the country faces a “particularly challenging outlook” due to internal fractures.

The ongoing corruption scandal, which has already resulted in a sharp fall in public spending — the primary drag on growth in late 2025 — casts a long shadow. This scandal could further erode business confidence and paralyze government infrastructure and social spending, the traditional engines of Philippine economic expansion.

The consequent narrow fiscal space severely limits the government’s ability to counteract economic slowdowns with stimulus, creating a vicious cycle where private sector activity sags further in anticipation of political and policy instability.

Therefore, the Philippines in 2026 is likely to fare through a particular tension. Externally, it may hold its ground, leveraging its strategic position in electronics supply chains and benefiting from looser global financial conditions, but internally, the economy risks underperforming its potential.

The anticipated central bank rate cuts may be drawn into a deeper easing cycle, precisely because fiscal policy is impeded, attempting to compensate for the lack of government spending.

Growth will likely remain subdued in the first half of the year, contingent on the nation’s ability to shake off ongoing political concerns.

The country, in 2026, stands at a crossroads. Its economic fate hinges less on the predictable tides of global trade and monetary policy and more on its capacity for domestic political resolution and governance reform.

Without a clear path to restoring integrity in public finance and reinvigorating government-led investment, the benefits of external opportunities and easier monetary policy will be diluted.

The nation may avoid a crisis, but it could also miss its growth targets, trapped in a cycle of cautious recovery while neighboring economies with more stable political environments capitalize more fully on the same global shifts.

Ultimately, 2026 will be a test of institutional resilience for the Philippines and its ability to translate macroeconomic tools into tangible, confidence-driven growth.