- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

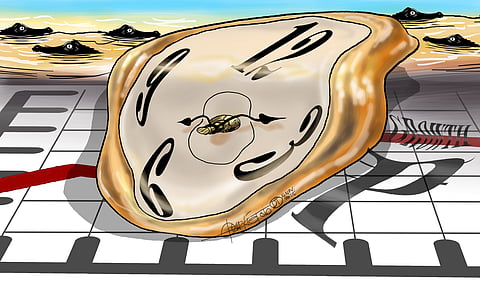

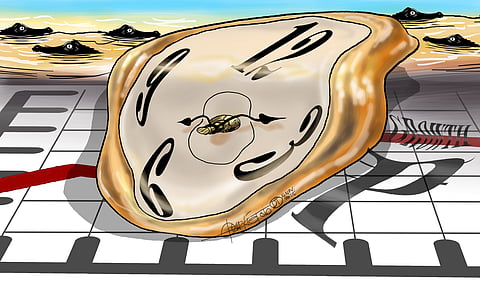

More than the confusing political signals, economic indicators are heading towards a danger level, increasingly driven by investors’ anxiety.

The signs are unmistakable. The same stalling of momentum was evident four decades ago, before the People Power revolt.

The Philippine stock market is in free fall, the peso has plunged to its weakest level and third-quarter GDP growth slowed to 4 percent. Foreign investments declined by 40 percent last August.

The economic numbers point to a stalling economic momentum, which is the result of declining business confidence.

An economist said the exchange of corruption allegations has chipped away at confidence in the government and would not benefit any partisan faction.

The sentiment now is that entrusting the solution to the same actors who contributed to the problem would be futile.

Under close market scrutiny, the peso has been falling to record lows, seen as a measure of the faltering confidence.

It is disheartening that just a few years ago, the economy showed resilience against global shocks, shielded by a continuous flow of remittances from overseas Filipino workers, or OFWs and the business process outsourcing (BPO) boom.

The peso stood out as a haven when US-China trade tensions intensified, as most Asian currencies were battered by geopolitical volatility and tariffs.

Remittances, which have remained strong, are being undermined by allegations stemming from the corruption scandal revealed by President Ferdinand Marcos Jr.’s anti-graft campaign.

Overseas transfers remain resilient, with the latest government data showing cash remittances sent through banks in August rising 3.2 percent from a year ago to $2.98 billion, up slightly from July.

The infrastructure scandal, centered on allegations of fraudulent contracts, the pilfering of public funds and public works paid for but never built, has triggered a crisis of confidence that is reflected in the market.

The peso weakened to a record intraday low of 59.262 per dollar on 28 October, sinking below the previous all-time low of 59.168 set in 2022. The currency was at 59.17 per dollar last Friday.

The scandal has had a chilling effect on investor sentiment, sapping growth potential.

Without the political noise, analysts suggested growth could have been closer to 6 percent.

An economist at a stock brokerage firm said visible results on the corruption issues would be the only way to regain the confidence of foreign investors.

“The government needs to win back credibility by instilling policy reforms across all government institutions.”

An investment banker lamented that investors have again written off the Philippines for now because of “weak integrity.”

“A lot of the spending they made wasn’t productive at all,” the investment banker said.

The belief that a weak peso is good for OFWs’ dollar earnings since it means more local currency, thus boosting household purchasing power and fueling consumer spending, does not hold under the current conditions.

“For a net importing country, a weaker peso can feed into higher fuel, food and debt costs, potentially weighing on growth,” an economist at a conglomerate said.

“Rising prices may offset most of the OFW gains,” he added.

The strength of the peso and the stock market had always been the weather vanes of the economy, making this forecast not at all favorable.

A fundamental change must occur to restore the confidence lost.