- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

For many Filipinos, the dream of owning a home often feels out of reach because of high costs and steep monthly payments. This October, Pag-IBIG Fund is rolling out a special housing loan rate that could change that.

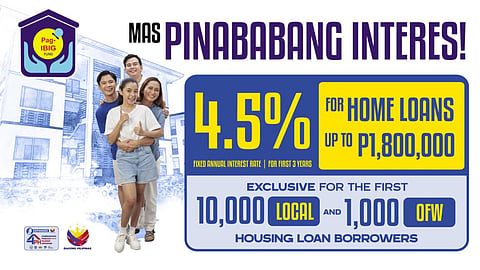

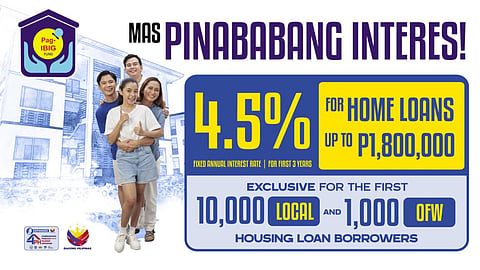

As part of the Marcos administration’s Expanded Pambansang Pabahay para sa Pilipino (4PH) Program, the agency will offer a 4.5 percent interest rate for house-and-lot packages worth up to P1.8 million. The initiative coincides with National Shelter Month, underscoring the government’s push to make dignified housing more accessible.

The program will cover the first 10,000 loan applications from locally employed members and 1,000 applications from Overseas Filipino Workers. The 4.5 percent annual interest rate will be fixed for the first three years of the loan. Applications already in the pipeline, once the program begins, will also be eligible for the subsidized rate.

Compared with the current 6.25 percent rate for similar loans, the new offer makes a significant difference in affordability.

“We continue to heed the call of President Ferdinand R. Marcos Jr. to provide affordable and inclusive housing for every Filipino family,” said Department of Human Settlements and Urban Development Secretary Jose Ramon Aliling, who also chairs the Pag-IBIG Fund Board of Trustees. “Just last July, we introduced a subsidized 3 percent rate for the first five years of loans for socialized housing units. Now, we are further expanding access to affordable home financing by offering a special rate for loans of up to P1.8 million, which exceed the socialized housing ceiling. This is another important step in broadening access to dignified and sustainable homeownership.”

The offer is open to first-time homebuyers who are active Pag-IBIG Fund members with at least 12 months of savings. Qualified members must earn less than P47,856 monthly in the National Capital Region, or less than P34,686 in other regions. Overseas Filipino Workers automatically qualify, regardless of income.

Members can use the loan to purchase a house and lot, acquire a residential lot, build or complete a home, make improvements, or even buy a Pag-IBIG Fund Acquired Asset.

Pag-IBIG Fund Chief Executive Officer Marilene C. Acosta explained that the new rate can ease the burden for many families. “This program makes even non-socialized housing more affordable and responds to the needs of Filipino families who prefer house-and-lot units that offer more space, privacy and long-term value,” Acosta said.

She added that for a P1.8 million loan payable over 30 years, the monthly amortization drops to P9,120.34 at the promotional rate of 4.5 percent, compared to P11,082.91 at the regular 6.25 percent. “Through this initiative, we not only provide substantial savings, we also help turn the dream of homeownership into reality. This effort supports President Marcos’ vision of a better, more secure life for every Filipino. At Pag-IBIG Fund, we remain committed to serving our members with compassion, efficiency and integrity, because every Filipino deserves a home they can truly call their own.”

With nearly P2,000 in monthly savings, or about P71,000 over three years, Pag-IBIG Fund’s new offer makes a simple but profound promise: that the key to a Filipino family’s future home may be more within reach than ever before.