- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

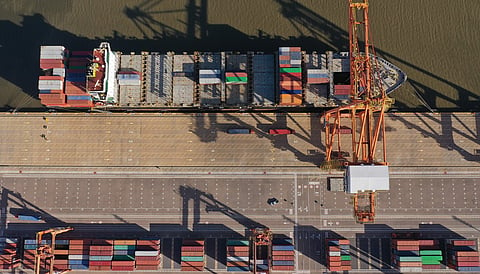

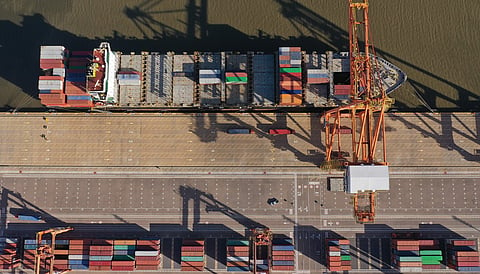

Global ports operator International Container Terminal Services Inc. (ICTSI) continues to see room for growth this year even as it keeps a close watch on any potential fallout from U.S. President Donald Trump’s trade policies.

While the full impact on its operations remains uncertain, ICTSI Chairman and President Enrique K. Razon Jr. on Thursday cautioned that the company’s terminal in Mexico could be vulnerable if sweeping import tariffs remain in place.

“It’s too early to tell the impact since Trump is flip-flopping every day,” Razon said at ICTSI’s annual shareholders’ meeting. “It is also early to tell how these tariffs will settle.”

Still, he acknowledged that of ICTSI’s portfolio of terminals across the globe, its Manzanillo terminal in Mexico is the most exposed.

“The only major impact that could be possible would be at the Manzanillo terminal in Mexico, but so far it is still a wait-and-see,” he said.

For ICTSI, a major trade disruption involving the U.S. could have ripple effects, but Razon pointed to the company’s relatively limited exposure to U.S. trade.

“Out of our portfolio, trade with the U.S. is only 3 percent,” he said. That narrow exposure, he added, could even open up strategic advantages should China seek to redirect its exports amid U.S. tariff pressures.

“There could be benefits,” Razon said. “I suspect with the massive industrial installed capacity of China that they will be looking for another market. So it may be offset — one offsets the other.”

In 2024, ICTSI reported a record net income of $849.8 million, up 66 percent from the previous year, driven by strong revenues and cash flow amid higher container volumes, an improved cargo mix, adjusted tariffs, and expanded services.

Revenues rose 15 percent to $2.74 billion, while free cash flow increased 12 percent to $1.08 billion. EBITDA grew 18 percent to $1.78 billion, with margins improving to 65 percent from 63 percent in 2023.

Port operations earnings also climbed 15 percent to $2.74 billion. Operating expenses rose 10 percent, mainly due to volume growth and salary increases.

The company handled 13.07 million TEUs last year, up 2 percent, boosted by new services and trade activity. Stripping out the effect of new and discontinued operations, volume grew 5 percent.

Capital spending reached $517.1 million in 2024, with investments in Mexico, Brazil, Indonesia, and the Philippines.

ICTSI plans to raise up to $580 million this year to support its global expansion.