- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

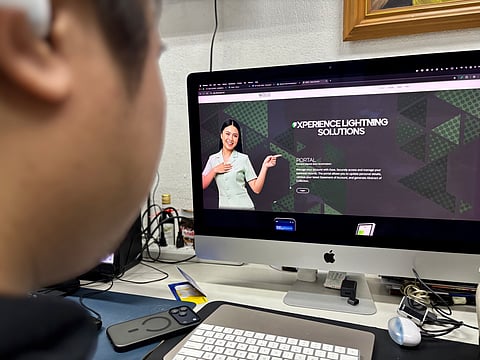

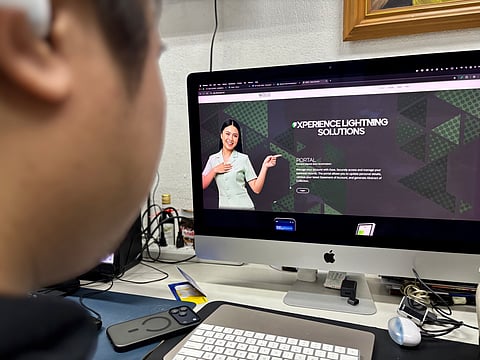

The Social Housing Finance Corporation (SHFC) has quietly upgraded its public-facing website and online services, a move officials say is meant to improve access, transparency and the delivery of housing finance services to low-income Filipino families. The refresh, first reported in late 2025 and reflected on the agency’s live web portal, forms part of SHFC’s broader push to digitize key frontline services ahead of planned program expansions in 2026.

The relaunched site adopts a cleaner, mobile-friendly layout, consolidating program information, news and client-facing e-services including an account portal, SMS notifications and a kiosk interface that lets beneficiaries retrieve statements of account and other essential records. The portal’s functionality, visible on the SHFC domain and on the agency’s integrated DHSUD subdomain, is designed to cut physical steps for applicants and borrowers while improving record accuracy.

Officials frame the upgrade as timely. SHFC is at the center of a policy push to scale up community-led housing and vertical social housing projects under the national 4PH program. In January 2026 the agency marked its 22nd anniversary and announced partnerships, including one with the Land Registration Authority (LRA), to expedite titling and registration for housing beneficiaries. A more robust online presence, SHFC argues, complements these administrative reforms by speeding document retrieval and case tracking.

What’s new and why it matters

The redesigned website places emphasis on four user journeys: program discovery (how to join Community Mortgage or 4PH projects), account management (statements, loan balances, payment histories), public notices and compliance resources for partner local governments and civil society organizations. The portal also highlights SHFC’s Enhanced Community Mortgage Program (ECMP), a faster, retooled version of the agency’s flagship CMP rolled out in 2025. By steering inquiries and basic transactions online, SHFC aims to lower the administrative burden on staff and reduce delays for beneficiaries.

The site update aligns with DHSUD’s stated objective of full digitalization among Key Shelter Agencies and the national drive to integrate government services into shared platforms. SHFC has signaled plans to integrate some services with government e-government initiatives, including potential connectivity with the DICT’s eGovPH app and other portals — steps that would let homeowners and community associations check application status or submit documents via mobile devices.

For beneficiaries, many of whom are informal settlers or organized community associations, the website is intended to be more than a brochure. SHFC’s portal now advertises SMS alerts for loan status updates, online generation of collection abstracts, and kiosks in select offices that can print official documents on demand. These features are particularly relevant in provinces where travel to regional offices adds time and cost to application and titling processes.

Challenges and the path ahead

Digital upgrades do not eliminate underlying capacity constraints. Internet-dependent services must be paired with offline support for communities with limited connectivity. SHFC’s plan to fast-track legacy housing projects, revive stalled CMP sites and scale vertical developments will require field capacity, stronger coordination with the LRA and local government units, and clear user education so beneficiaries can use online tools effectively. Recent reporting shows SHFC moving to establish special LRA lanes for titling work, a complementary administrative fix to the website’s online conveniences.

As SHFC deepens its role in the government’s housing agenda for 2026, the website refresh is a practical step toward greater transparency and operational efficiency. If the agency follows through on integrating frontline services with national e-government platforms and pairs digital access with on-the-ground assistance, the upgraded portal could help shorten waiting times, reduce paperwork bottlenecks and make housing finance more navigable for thousands of low-income families.