- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

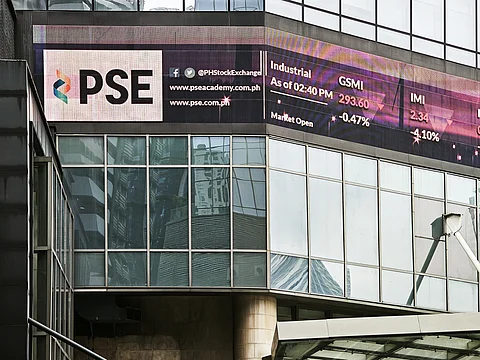

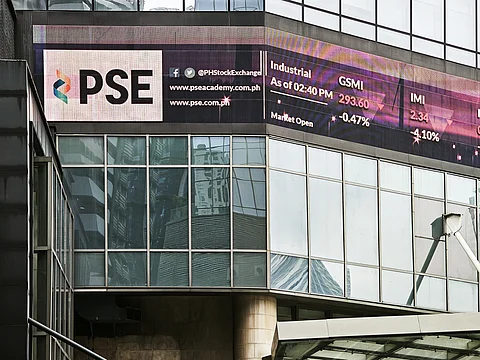

The Philippine Stock Exchange Index (PSEi) fell to a new three-year low on Friday, closing at 5,739.37 — down 1.31 percent — as investors reacted to weaker-than-expected economic growth figures and softer third-quarter corporate earnings.

The benchmark index has now slipped below lows recorded earlier this week, dropping further from its 5,806.81 close on 3 November. Market sentiment remained fragile following the country’s 4 percent GDP growth in the third quarter — its slowest pace in more than four years — which analysts said continues to weigh on equity valuations.

The sustained weakness of the peso, which closed at P59.04 against the US dollar — its third straight day of slight depreciation — added to the cautious mood. The exchange rate remains just below October’s peak of P59.26.

All major local indices declined, with broad risk-off sentiment spreading across sectors as investors reassessed valuation risks among AI-linked technology stocks. Market breadth reflected the downbeat tone, with 72 gainers, 117 losers, and 52 unchanged, while total turnover reached P8.41 billion, excluding block sales.

External pressures also contributed to the sell-off. US equities slipped 0.8 percent–1.9 percent, hitting two-week lows after data from Challenger, Gray & Christmas showed the largest October job cuts in more than 20 years. Investors were likewise cautious following skepticism from the US Supreme Court regarding the legality of former President Donald Trump’s tariffs, and after warnings from Wall Street leaders — including executives from Goldman Sachs and Morgan Stanley — about the risk of a potential market pullback amid stretched AI-driven valuations.

The peso’s decline to P59.04 per dollar was driven largely by continued US dollar strength, as markets increasingly expect the Federal Reserve to keep interest rates higher for longer. This has pushed investors toward dollar-denominated assets and away from emerging-market currencies such as the peso.

At the same time, global risk-off sentiment and concerns over the Philippines’ slowing economic momentum have reduced foreign inflows, adding further pressure on the currency. With the Bangko Sentral ng Pilipinas maintaining its stance of allowing the exchange rate to be market-driven — intervening only to curb excessive volatility — the peso continues to adjust more freely to these external forces.