- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

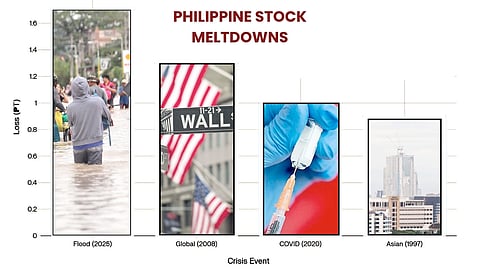

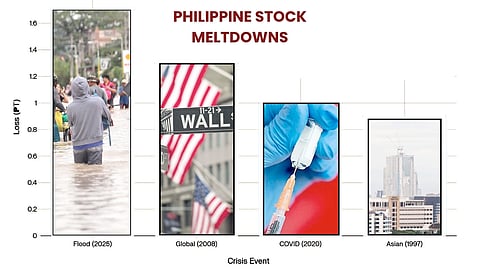

The Philippine stock market has lost an estimated P1.7 trillion in value in just three weeks following the flood control projects scandal, as the strong whiff of corruption has eroded investor confidence despite strong corporate fundamentals.

Speaking at the 57th Annual Conference of the Financial Executives Institute of the Philippines on Tuesday, Securities and Exchange Commission (SEC) Chairperson Francis Lim warned that the scandal has “shaken public confidence” and triggered massive selloffs that have little to do with company performance.

“The flood control projects scandal has shaken public confidence, wiping out an extraordinary P1.7 trillion in market value of our publicly listed companies in just three weeks, despite rising corporate earnings,” Lim said.

“Investors aren’t fleeing because of weak fundamentals; they’re fleeing because of weak integrity. It’s a stark reminder that corruption is a weapon of mass wealth destruction,” he said.

Lim said the SEC views compliance and good governance as critical to restoring trust and stability in the capital markets.

“This is not just a market issue; it’s a trust issue. Rebuilding that trust is one of the SEC’s most urgent missions. When trust breaks down, capital dries up, and everyone — government, business, and the public — pays the price,” he stressed.

To help restore market confidence, Lim said the SEC is rolling out reforms to make compliance “simpler, fairer and smarter.”

These include a 50-percent cut in fees for corporate information access, discounts for micro, small, and medium enterprises, and a rule that automatically approves certain applications if the regulator fails to act within the prescribed period.

He added that the SEC has expanded its digital initiatives, including OneSEC, which now allows company incorporation in under two hours, alongside measures to streamline capital-raising procedures.

Lim said the commission’s upcoming Strategic Plan will also help widen access to capital, deepen investor trust, modernize regulation through digital innovation, and strengthen the SEC’s institutional capacity.

On Wednesday, the Anti-Money Laundering Council (AMLC) secured its fifth freeze order from the Court of Appeals in connection with the ongoing investigation into irregularities in flood control projects.

The order covers additional bank accounts linked to persons of interest, including an entity allegedly used in the implementation of ghost projects.

“Every freeze order matters. Each freeze order secured strengthens the evidentiary trail, ensuring that illicit funds cannot be concealed or dissipated,” AMLC executive director Matthew M. David said in a separate statement.

The AMLC has so far frozen over P4.4 billion in assets, including 1,632 bank accounts, 54 insurance policies, 163 vehicles, 40 properties, and 12 e-wallet accounts. The total is expected to increase with the latest order.

The current slump echoes past market downturns tied to political and economic crises that have shaped Philippine financial history.

Debt-driven spending and fiscal mismanagement in the early 1980s sparked high inflation and soaring interest rates, eroding liquidity. Between 1980 and 1984, Philippine equities lost more than half their real value. The market rebounded briefly after the 1986 People Power Revolution but tumbled again during the coup attempts in 1987 and 1989, wiping out roughly P80 billion (P250 billion today).

2008 global financial crisis

In October 2008, as the world reeled from the collapse of major investment banks, the PSEi fell nearly 17 percent in just three weeks, wiping out hundreds of billions of pesos in market value. Blue-chip shares led the selloff as investors fled to safety amid fears of a global recession. The magnitude and pace of the decline were unmatched at the time — until now.

2020 Covid-19 pandemic crash

A similar free fall occurred in March 2020, when lockdown fears and economic paralysis sent the PSEi tumbling more than 25 percent in less than a month. Trading halts were repeatedly triggered as panic selling gripped investors. By late March, the index had hit decade lows, erasing trillions in capitalization as the Covid pandemic’s toll became clearer.

1997 Asian financial meltdown

During the Asian financial crisis, the market shed over 30 percent of its value in just three weeks between July and August 1997. The peso collapsed, capital fled, and foreign funds dumped local assets, sending the PSEi into a tailspin. The selloff was swift and emotional, driven by fear of contagion rather than earnings fundamentals.