- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

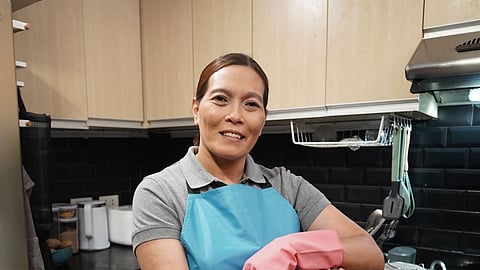

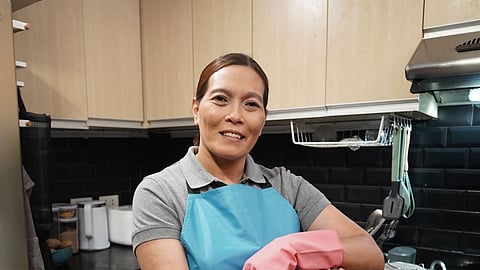

Josephine Russiana, 45, works as a condominium cleaner in Bonifacio Global City, Taguig. As a mother of three, every peso she earns counts. Yet, some days, her income falls short of meeting her family’s daily needs.

Her husband, formerly a motorcycle taxi rider, had to give up the job when they could no longer keep up with the vehicle’s monthly payments. Now a part-time family driver, he provides only a limited second source of income.

"Kumikita ka, pero minsan kinakapos ka talaga," Josephine admits. (I bring in money for my family but sometimes it is not enough.)

Josephine recalls a day when she couldn’t afford her children’s school baon, typically splitting a P200 budget among her kids. Fortunately, she remembered what a friend told her once: GCash offers cash loan products to eligible users. As a GCash user, she tried and found out that she was eligible. Josephine was granted P100 instantly.

GLoan Sakto allows borrowers to access funds digitally, removing the embarrassment of face-to-face lending and avoiding unregulated “5-6” lenders who charge exorbitant rates. Even small amounts, often called “pambale,” can help cover immediate needs like a few kilos of rice or canned goods.

The next time she needed to borrow money, Josephine says GCash offered her P300, an increased credit limit after paying on time several times. After maintaining and fulfilling good repayment behaviors, on her next loan cycle, she was extended an increased loan limit of P1,000, which she used for food and utility expenses.

“Wala pang due, binayaran ko na. Hindi po ako nagpapa-overdue,” she says. (I pay before the due date. I never let anything go overdue.)

For many Filipino families, even modest loans are the first step toward formal financial inclusion. “Josephine’s story reflects why we launched GLoan Sakto—to give hardworking Filipinos access to safe, reliable, and dignified credit,” says Tony Isidro, president and CEO of Fuse Financing Inc.

“To date, Fuse has served 9.5 million unique borrowers, 90% of whom are first-time users of formal credit,” Isidro adds. “Small, responsible loans can build confidence and financial stability, especially for those traditionally excluded by other lenders.”

Through GLoan Sakto, GCash and Fuse Financing Inc. continue to empower Filipinos to rise above daily financial struggles, offering not just immediate relief, but a pathway toward long-term financial confidence.

For more information on GCash lending products, visit gcash.com.