- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

The National Home Mortgage Finance Corporation (NHMFC) has successfully completed its seventh securitization offering, NHMFC Bonds 2024, raising P1.3 billion and earning very strong credit ratings from the Philippine Rating Services Corporation (PhilRatings).

PhilRatings assigned a Final Issue Credit Rating of PRS Aa minus to the P1 billion Class A Senior Notes with a coupon rate of 4.9654 percent and PRS Baa to the Php300.3 million Class B Subordinated Notes. Both ratings carry a stable outlook. Obligations rated PRS Aa are considered high quality with very low credit risk, while PRS Baa obligations have adequate protection parameters. A stable outlook indicates the ratings are expected to remain unchanged in the next 12 months.

NHMFC Bonds 2024 marks the corporation’s second-largest bond issuance to date. Backed by 1,658 long-term, low-delinquency residential loans, the bond underscores NHMFC’s commitment to supporting the country’s housing sector.

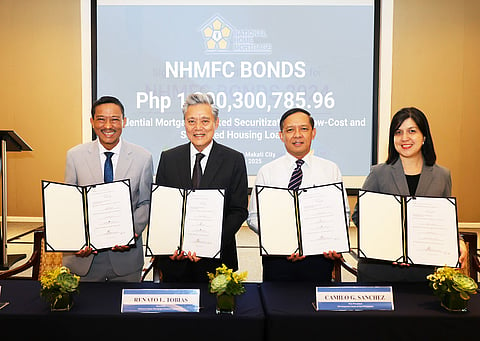

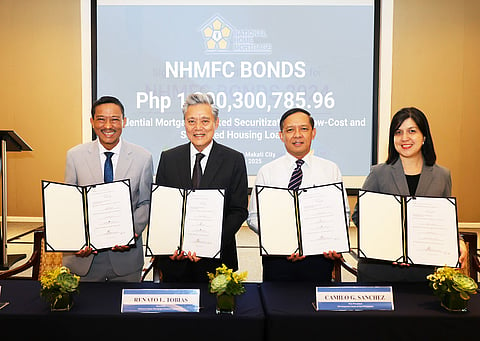

“More than a financial instrument, the NHMFC Bonds symbolize our collective commitment to making homeownership more accessible and affordable for many Filipinos across the nation,” said NHMFC President Renato L. Tobias during the signing ceremony held on 15 September 2025. He highlighted that the bond issuances help turn Filipino families’ dreams of secure and sustainable homes into reality.

NHMFC Acting Executive Vice President Maria Luisa M. Favila noted that while securitization is still gaining traction in the domestic capital market, the international market has begun taking notice of NHMFC due to the improved sovereign rating outlook. “The corporation will continue to strive to have a new pool of investors and pool of assets and issue different financial instruments to help in the funding requirements for housing,” Favila added.

Key partners in the transaction included the Development Bank of the Philippines as special purpose trust administrator, Landbank of the Philippines as arranger and underwriter, MOSVELDTT Law Offices as transaction counsel and tax advisor, Philippine National Bank as trustee, registrar, and paying agent, PhilRatings as the credit rating agency, and MOORE Roxas Tabamo and Co. as portfolio auditor.

The successful bond issuance highlights NHMFC’s strategic role in financing the nation’s housing sector while creating opportunities for investors and further strengthening the country’s capital markets.