- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

TransUnion has reported that Filipinos are showing stronger trust in credit products even as high borrowing costs and fraud concerns continue to temper usage.

In its third annual Credit Perception Index (CPI) released Tuesday, the global information and insights company said the Philippines posted a 2025 CPI score of 73, only a point lower than 2024’s 74. The index measures how Filipinos perceive credit, the factors influencing their behavior, and the implications for the country’s financial system.

Trust in credit products jumped six points, indicating improving confidence, while receptivity to credit messaging – Filipinos’ likelihood of using credit after learning about its benefits – fell by nine points. TransUnion attributed the decline to external pressures such as higher interest rates and mounting concerns over digital fraud.

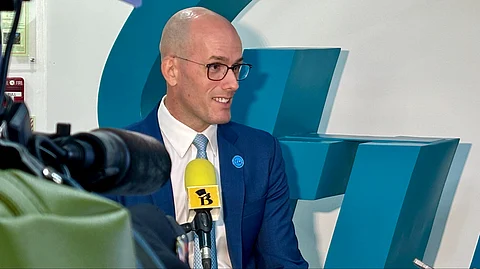

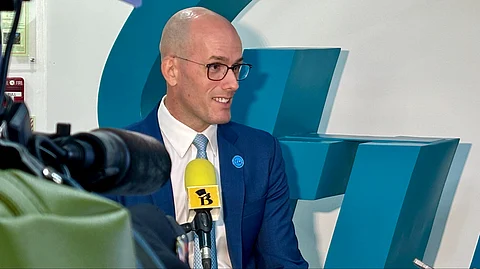

“We are glad to see the CPI score holding largely steady in 2025, supported by growing trust in credit products,” said Peter Faulhaber, President and CEO of TransUnion Philippines.

“More encouragingly, this year’s CPI results also tell us that Filipinos are eager to learn more about financial options that are relevant, accessible, and suited to their needs.”

The report found that nearly seven in 10 Filipinos – 69 percent – said they were knowledgeable about credit, with rising interest in specific products such as payday loans, micro loans, mobile loans, personal loans, and buy now, pay later schemes.

Despite these gains, deterrents remain. High interest rates were cited as the top barrier to credit use by 59 percent of respondents, followed by scams and fraud at 52 percent. Security and trust ranked just behind convenience as the most important factors when choosing a financial service provider.

A closer look at segments showed that the CPI score for the unbanked improved to 67 in 2025 from 65 in 2024, narrowing the gap with the general population. This was driven by sharp increases in both trust and knowledge of credit products.

For the first time, TransUnion also measured perceptions among FinTech users, who emerged with the highest CPI score at 74 and the strongest general credit knowledge at 71 percent. Adoption of digital financial services is now widespread, with 91 percent of respondents using at least one FinTech product. E-wallets remain the most common entry point, particularly for younger Filipinos.

“The strong performance of FinTech users and the narrowing gap between the unbanked and general population reflect encouraging momentum toward greater financial inclusion,” Faulhaber said.

“However, to fully unlock the benefits of credit, we must continue addressing persistent barriers – especially fraud and security concerns that deter many from engaging with credit.”

TransUnion said that while Filipinos are more open to learning and engaging with financial products, a safer and more supportive credit environment will be critical to expanding participation and building a financially resilient population.