- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

Top officials of Mitsubishi Motors Corporation (MMC) said the newly launched joint venture (JV) of MMC and Security Bank Corporation, dubbed Mitsubishi Motors Finance Philippines, Inc. (MMFP), would further increase the Japanese car company’s footprint and share in the Philippines.

The JV, a new financial services initiative, was designed to enhance the customer experience and support the growth of Mitsubishi Motors’ mobility solutions.

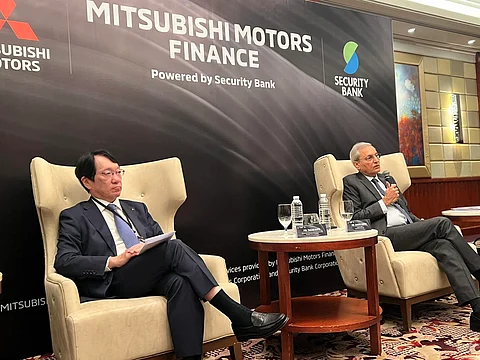

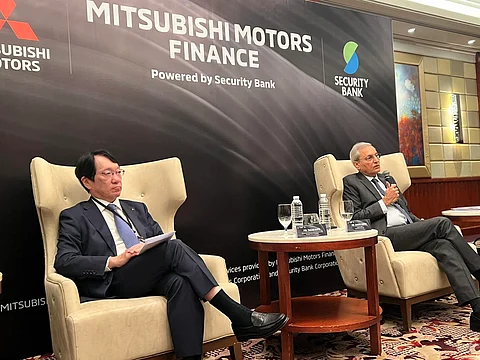

“The current market share of MMC in the Philippines is 19.5 percent. With this JV, we aim to make the market share more than 20 percent in the first step. In five years, we will target 25% or more,” said Mr. Takao Kato, Representative Executive Director for the President and CEO of MMC, in a media briefing on Friday at the Shangri-La Makati.

For the part of Security Bank, its President and CEO, Sanjiv Vohra, treats the JV as a strategic milestone.

“For us, it’s an opportunity to deepen our relationship and partnership with Mitsubishi, and more importantly, expand our footprint in the auto finance market. We have had a very strong growth in auto financing in the last couple of years. Our loan growth last year reached over 50 percent in terms of auto loans,” Vohra said.

“With this JV, we expect the partnership to help us become a preferred financier for Mitsubishi vehicles. Our objective is to enable Mitsubishi Motors to achieve its goals of improved market share through providing innovative options and flexible options,” he added.

For the first quarter of the year, Security Bank’s auto loan financing reached 52 percent, and Vohra said they are expecting the trend to continue.

MMFP is being run by Satoshi Nakano as President and Chief Executive Officer.

The JV that formed MMFP stipulates that MMC will own a 51 percent share, while Security Bank owns a 49 percent share.

MMC, a global automobile company based in Japan, has a strong market presence in the Philippines with over 60 years of history.

Through its nationwide dealer network, MMC provides reliable vehicles and services that continue to earn the trust of Filipino customers.

Leveraging the expertise of both companies, MMFP offers financial services such as loans and leases to Mitsubishi Motors customers in the Philippines, helping them achieve their dream of car ownership.

Under the brand “Mitsubishi Motors Finance powered by Security Bank,” MMFP started operations at five Mitsubishi Motors dealerships in April and now offers financing solutions across all 67 Mitsubishi Motors dealerships nationwide.

The nationwide rollout marks a key milestone in Mitsubishi Motors’ mid-term business plan, Challenge 2025, which positions ASEAN as a core growth region, with MMFP playing a strategic role in driving that expansion in the Philippines.

With a steadily growing population and strong economic fundamentals, the Philippine automotive market is on a clear growth path.

In FY2024, Mitsubishi Motors sold 91,639 units locally—a 12 percent increase year-on-year—cementing the Philippines as one of its top ASEAN markets with a 19.5 percent market share.