- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

The Bangko Sentral ng Pilipinas (BSP) and the Bureau of the Treasury (BTr) have recently signed a memorandum of Understanding (MoU) to reinforce collaboration in strengthening two key pillars of the country’s financial system: government securities trading and large-value fund transfers.

The agreement aims to enhance the operational efficiency, security and resiliency of critical infrastructure, particularly the Philippine Peso Real-Time Gross Settlement (RTGS) System operated by the BSP, and the National Registry of Scripless Securities (NRoSS) maintained by the Treasury. These systems are instrumental in processing trades and settlements of government securities and other high-value financial transactions.

Also included in the scope of cooperation between the BSP and BTr are related mechanisms such as the Delivery versus Payment (DvP) system and the Intraday Settlement Facility. These are expected to contribute to minimizing systemic risks and improving the flow of liquidity across the financial system.

Renewed emphasis on capital markets and safeguards

The MoU comes at a time when authorities are placing renewed emphasis on deepening capital markets and fortifying safeguards in the face of growing volumes of electronic transactions.

BSP Governor Eli M. Remolona Jr. underscored the MoU’s significance, describing it as a catalyst for ongoing institutional collaboration.

“It’s to tell us that we have work to do, and we have to work together to do that work,” Remolona said, citing areas such as managing systemic risk and capital market development as joint priorities.

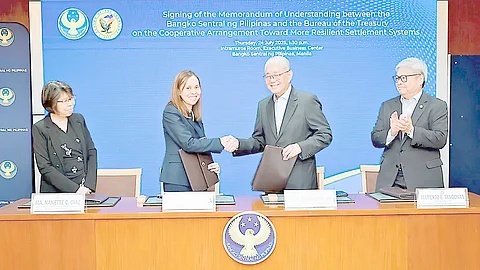

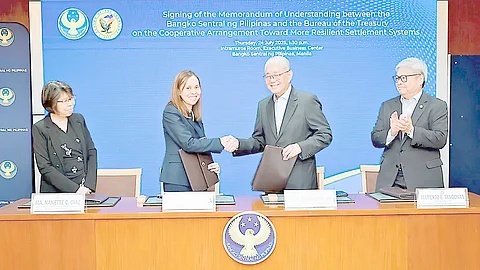

Signing the agreement were Governor Remolona and Treasurer of the Philippines Sharon P. Almanza, with BSP Deputy Governor Mamerto E. Tangonan and BTr Officer-in-Charge Deputy Treasurer Ma. Nanette C. Diaz serving as witnesses.

The ceremony was also attended by members of the BSP Monetary Board and senior officials from both institutions — further underscoring broad policy support for enhancing the country’s financial market infrastructure.