- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

S&P Global Ratings has revised its rating outlook of Meralco to positive from stable. At the same time, it affirmed its “BBB” long-term issuer credit rating on the integrated power utility firm.

S&P said its positive Meralco outlook reflects its expectation that business integration, scale and diversity could improve with project execution in power generation, without material delays or cost overruns.

“We forecast an adjusted ratio of funds from operations (FFO) to debt of about 30 percent or higher for 2025-2027 despite high capex,” the ratings firm said.

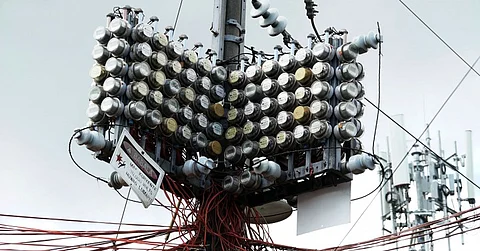

Dominance in power distribution

S&P noted that the renewal of Meralco’s distribution franchise will support its dominance in Philippine power distribution.

Meralco’s existing franchise is set to expire in June 2028. In April 2025, Meralco renewed it for another 25 years, until 2053.

“Backed by this exclusive franchise, the company will likely maintain its natural monopoly within its franchise area, including Metropolitan Manila, the Philippines’ national capital and economic center,” said S&P.

Meralco continues to serve 39 cities and 72 municipalities, including Metropolitan Manila. A significant portion of the company’s revenue comes from Metropolitan Manila.

Franchise area output

The output from the company’s franchise area accounts for about 50 percent of the national GDP. The economic weight and importance of this franchise area supports demand for power and the company’s continued growth.

S&P sees Meralco’s growing scale and market position in power generation as strengthening its business diversification as an integrated power utility.

In January, the company acquired a 60 percent stake in Chromite Gas Holdings Inc.; CGHI owns a 67 percent interest in two operational natural gas power plants with a total capacity of 2.6 gigawatts (GW) (effective stake of 40.2 percent). It is also constructing a 3.5 GW Terra solar project under its 60/40 joint venture with Actis. These will increase Meralco’s gross operating generation capacity to 8.8 GW by 2027 from 2.6 GW in 2024.

“We forecast that the Terra solar project and CGHI will contribute to 24 percent and 7 percent of Meralco’s adjusted EBITDA by 2027. We assume predictable cash flow from the projects, given their long-term power supply agreements with favorable tariffs. These upstream investments will also help Meralco better secure power supply and evolve as an integrated power utility from a stand-alone distribution company,” said S&P.

Terra solar project

The first phase of the Terra solar project (2.5 GW) is on track and could be operational in the first half of 2026, with the second phase (1.0 GW) in 2027.

S&P expects execution risks to be manageable without material delays. “This, given the less complex nature of solar projects, their low gestation period, and Meralco’s experience in developing such projects,” said the ratings firm.

Added S&P: “The addition of significant renewable energy capacity could also improve profitability for Meralco’s generation business. This is because solar projects have EBITDA margins exceeding 80 percent. We forecast Meralco’s adjusted EBITDA margin to improve to 21 percent-22 percent by 2027 from 16 percent in 2024.”