- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

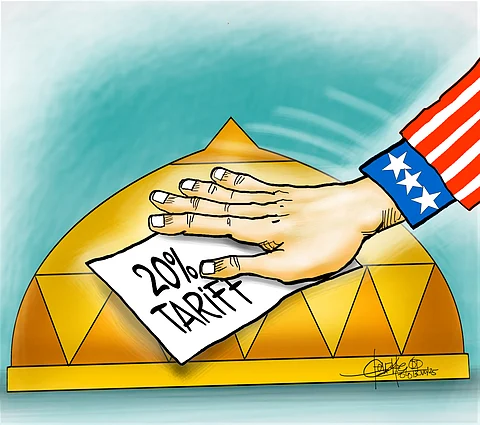

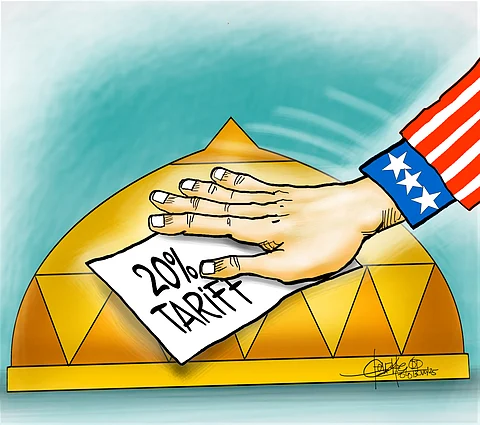

Filipinos residing in the United States and their families back home, along with economists, are having palpitations not over the recent headlines of a 20-percent reciprocal tariff on the country, but over US President Donald Trump’s domestic measure.

Trump signed The One Big Beautiful Act on Independence Day, 4 July, which now means that residents who are non-US citizens, including green card holders, visa holders (H-1B, L-1), temporary residents, and undocumented immigrants, will face a 3.5-percent excise tax on all personal remittances sent abroad.

The tax does not discriminate based on the transfer size and is collected by banks or remittance providers.

Analysts said monthly transfers, which have been a major driver in keeping the Philippine economy at a steady pace, will take a direct hit.

Deutsche Bank Research stated that the US tax may reduce the inflow of remittances by 1.4 percent. As of the first quarter, the US has contributed around 45 percent of total overseas Filipino remittances segregated by region.

A Metrobank Wealth Insights research indicated that the potential remittance dip may pull down consumer spending, another key engine of economic expansion.

The US is a significant source of remittances for approximately two million Filipinos residing in the country.

Transfers from Filipino migrants reached a record high of $39.3 billion in 2024, and the figure continues to grow despite the raft of geopolitical crises that were initially expected to affect dollar inflows.

Remittances spur household spending, which contributes 78.2 percent to the gross domestic product (GDP), the research indicated.

The big bill is projected to increase the US’ debt by $3.4 trillion over the next decade.

As the US seeks funding to address the increased expenditure, interest rates are expected to edge higher as early as next year.

Higher rates would, in turn, attract foreign capital to the US, away from emerging market economies like the Philippines.

The Bangko Sentral ng Pilipinas (BSP), in response, could increase the Reverse Repurchase (RRP) Rate to ensure the Philippines remains competitive in attracting capital.

The higher cost of money will discourage consumption and business investments, potentially slowing economic growth.

When the US government ramps up borrowings, private investment is at risk of being “crowded out” as borrowing costs are pushed higher.

A decline in private investment could lead to a substantial slowdown in US GDP growth, according to the Metrobank report.

Such a situation would affect the Philippines, considering that the US is one of the country’s top export destinations.

In 2024, exports to the US amounted to $12.14 billion, comprising 16.6 percent of the Philippines’ total annual exports.

With potentially hampered US economic growth, goods from the Philippines could face reduced demand, the paper explained.

Fewer exports, combined with steeper tariffs, can exacerbate the trade deficit and weigh on overall GDP.

Softer US growth could also limit foreign direct investment in emerging markets like the Philippines, as US investors become more conservative. While Trump’s tariff offensive will have a limited effect on the economy, considering the amount of exports to the mainland.

The US is the top export destination, but it accounted for only 16.6 percent of total Philippine receipts in 2024, and 15.7 percent for the first five months of this year.

Trump’s policies, which are rightly in favor of strengthening the US economy, should serve as a cue for more competent Filipino economic managers to advance the country’s interests.

Some in the team, for instance, may have bungled the negotiations with the US, resulting in the jacking up of the trade toll from the initial 17 percent to 20 percent, the highest increase in the region.

Amid the blitz by the Trump administration to make America stronger, more aggressive and competent negotiators must represent the country.

The Philippine panel must capitalize on the country’s status as a strategic US ally.