- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

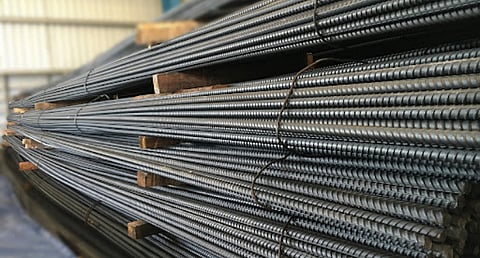

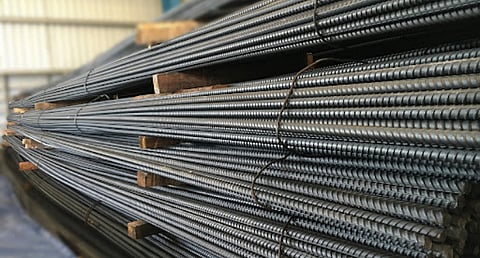

A confluence of increased construction activities and a slowdown in the property sector in China have resulted in the influx of imported building materials, many of which are substandard, based on government data.

The Department of Trade and Industry (DTI) indicated it has ramped up efforts to prevent the sale of substandard building materials in the local market.

Giant steel makers in China are racking up losses as a result of domestic overcapacity and poor demand.

World’s number-three Angang Steel lost nearly $1 billion last year, it said in a stock exchange filing.

China’s steel sector has been under pressure from a prolonged slump in the country’s real estate market, traditionally a major consumer, that has hit demand in the world’s second-largest economy.

Angang logged a net loss of seven billion yuan ($969 million) in 2024, compared with a 4.1 billion yuan loss the year before, its Hong Kong-listed unit said on Sunday.

The company blamed “severe market conditions” for the weak performance.

Those included the “persistent lack of downstream demand in the steel industry, combined with a weak cycle and low market sentiment.”

China is the world’s largest producer of steel, making more than a billion tons in 2024.

With demand slumping in the domestic construction sector, Chinese steel exports surged last year to a nine-year high of 111 million tons, spurring concerns abroad about overcapacity in foreign markets.

In February, US President Donald Trump said he would impose 25 percent tariffs on all steel imported into the United States, including those from China, from 12 March.

Vietnam and South Korea, the largest importers of Chinese steel, have also announced levies.

China’s top planning body said this month it aimed to cut steel output in 2025, without specifying a level of reduction.

“We’re going to strengthen our drive against substandard materials...as part of the job of the Fair Trade Enforcement Bureau. We’ve been meeting about this and I have asked them to come up with other ideas so that we can catch (those that sell substandard products),” Trade and Industry Secretary Ma. Cristina Roque said.

Roque emphasized that Task Force Kalasag (Shield), established last year to combat substandard products, will lead the efforts.

Earlier this month, the task force seized 20,815 units of non-compliant steel and other materials worth P1.44 million.

Roque said the DTI has included construction materials in the list of products under the Tatak Pinoy Act, which should be prioritized by government agencies for their projects.

“We have to make sure that first, they’re compliant, and that they’re (made by) Filipino manufacturing companies. And thirdly, they have to make sure also that they really pass the criteria of the Tatak Pinoy law, which has set a set of guidelines to qualify,” she added.

Republic Act 11981 or the Tatak Pinoy (Proudly Filipino) Act states that in collaboration with the private sector, “the state shall continuously support domestic enterprises in producing and offering products and services of increasing sophistication, generating safe and decent employment, crating sound supply-chain management systems, and adopting green technologies in production practices and in the formulation of a long-term sustainability criteria.”

The state shall encourage the continuous improvement, expansion and diversification of the productive capabilities of domestic enterprises and their linkages with local, regional and global value chains; and ensure that its initiatives to support domestic enterprises are market-driven or are in anticipation of future market demand.