- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

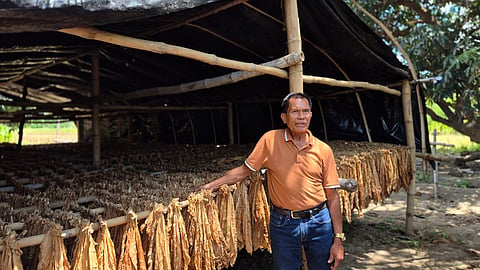

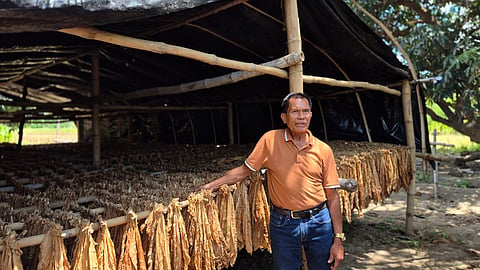

SAN FABIAN, Pangasinan — Tobacco farmers are calling on the government to appoint a “tobacco czar” to address issues plaguing the industry, including rampant smuggling that is hurting local production.

Saturnino “Ka Turning” Distor, president of the Philippine Tobacco Growers Association (PTGA), said smuggled cigarettes have flooded the market, cutting into the sales of local leaf buyers and reducing government revenues from excise taxes.

“We see a lot of smuggled cigarettes being sold openly. If these are illegal, why isn’t the government stopping them?” Distor said.

“This affects us farmers directly. Instead of more buyers purchasing our produce, they are competing with smuggled tobacco products.”

The government collects billions of pesos from excise taxes on tobacco products.

In 2023, the town of San Fabian received P37 million from excise tax collections, with 50 percent going to the provincial government. However, farmers argue that only a small portion reaches them.

San Fabian produces an average of 2,500 kilos of tobacco per hectare, but they say government support has dwindled. The local government currently allows only P1 million annually for farming incentives, covering around 500 farmers.

Distor is pushing for an ordinance to allocate P20 per kilo from excise tax collections directly to farmers.

“This would be a small but crucial help,” he said, noting that other municipalities provide up to P60,000 per hectare in farming aid.

Beyond financial support, Distor called for stronger anti-smuggling measures and a dedicated official to oversee the tobacco industry.

“We need someone solely focused on tobacco, just like other crops. This would help ensure that our concerns, from smuggling to proper tax allocation, are addressed,” he said. He also proposed stricter monitoring and a whistleblower hotline.

“If the government truly wants to stop smuggling, it needs to involve citizens and protect whistleblowers.”

The push for reforms comes as regulators consider raising tobacco excise taxes to curb smoking. However, Distor warned that excessive hikes could drive more consumers toward illicit cigarettes, further harming local farmers.

The Philippine Tobacco Institute Inc. (PTI) echoed these concerns in a position paper, calling for a dedicated Illicit Trade Task Force to bolster enforcement, border controls, and prosecution of smugglers.

Citing data from global research firm Kantar, PTI reported that illicit cigarettes surged from 5.4 percent of the market in 2020 to 16.4 percent in 2024, a more than 200 percent increase.

The study also highlighted a stark price disparity, with legal cigarettes averaging P170 per pack in 2024, while illicit products sold for P78.40, drawing consumers to untaxed alternatives and reducing government revenues.

Data from the Food and Nutrition Research Institute and the Bureau of Internal Revenue showed the fiscal impact, with excise tax collections dropping from P176 billion in 2021 to P130 billion in 2024, alongside a rise in adult smoking prevalence from 19 percent in 2021 to 24.4 percent in 2023.