- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

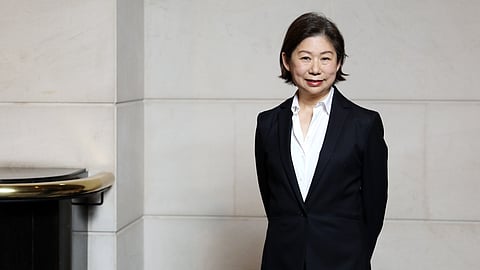

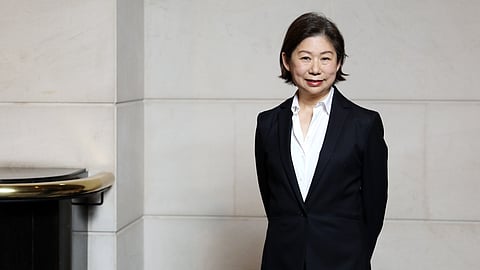

As the acknowledged leader of the SM conglomerate after her father’s death, Teresita “Tessie” Sy-Coson embodies the leadership that drives inclusive growth, serving as vice chairperson of SM Foundation Inc. and chairperson of BDO Foundation.

These organizations form the cornerstone of the SM Group’s commitment to creating a lasting, meaningful impact through its corporate social responsibility (CSR) initiatives.

Under Sy-Coson’s stewardship, the SM Foundation championed programs centered on education — scholarship and school buildings, self-sufficiency farming, and health — medical missions and health centers, transforming many communities across the Philippines.

In parallel, her leadership at BDO Foundation advances efforts in relief operations, health center renovation and financial literacy for teachers, uniformed personnel, farmers and fishermen, targeting to help uplift the underserved.

Her unwavering support for employment initiatives has positioned SM JOBS as a key driver of inclusive economic growth. By hosting more than 180 job fairs in SM malls, SM JOBS has facilitated opportunities for over 100,000 job seekers, with more than 14,000 individuals hired on the spot — a testament to her commitment to empowering communities and enhancing lives.

Sy-Coson’s vision reflects the SM Group’s philosophy of integrating business success with social purpose, ensuring that progress is shared by many. She is also instrumental in making the SM flagship, SM Investments Corp., a beacon of corporate governance in the business community. As vice chairperson, she also ensured that gender diversity is maintained in the company.

Former Bangko Sentral ng Pilipinas Governor Amando M. Tetangco Jr., who now sits as SMIC chairperson, attested to the conglomerate’s upholding the highest standards of corporate governance by going beyond mere compliance with regulatory standards.

“The mantra of good corporate governance must consider fair and acceptable behavior, among others, to those who are more vulnerable, even if it means accruing less to the bottom line. What we want to achieve is having the comfort that values, principles, and practices are fully in place, reviewed, and updated even when no one is looking and even if it does not always pay off, particularly in the short run,” Tetangco said.

Focusing on professionalization, accountability, sustainability and transparency, SM has been raising the bar on good corporate governance while promoting independent judgment and independent leadership.

Recently, SM moved to increase the size of its Board to give more than a majority, five out of nine seats, to independent directors, thus making decision-making more professional. Aside from its chairperson, SM’s roster of independent directors includes Sy-Coson; Tomasa Lipana, former chairperson and senior partner of Isla Lipana & Co., the Philippine member firm of PricewaterhouseCoopers; Ramon Lopez, former Secretary of the Department of Trade and Industry (DTI); Robert Vergara, who served as president and general manager and vice chairman of the Board of Trustees of pension fund Government Service Insurance System (GSIS); and Lily Gruba, a professor of Taxation Law, Mergers & Acquisitions, and Local Government Finance, and former director of the Philippine Economic Zone Authority, Overseas Workers Welfare Administration, and undersecretary of the Department of Finance.

Collectively, they exercise strong oversight and advisory capabilities. This board composition goes beyond current corporate governance standards, which prescribe at least 20 percent to 30 percent of boards be comprised of independent directors. Notably, out of the five independent directors, two are female. A diverse board further complements the thrust towards independent leadership and judgment, transparency, accountability, fairness and professionalism, ensuring the interests of various stakeholders are considered in board decisions and strategies.

On top of this, SM’s Related Party Transactions Committee is composed entirely of independent directors with the right to review any transaction or related relationship in the group. Deals are reviewed by this committee, and recent deals have had both auditors review alongside independent fairness opinions by third-party firms recommended by the Securities and Exchange Commission or the Philippine Stock Exchange. SM’s Audit, Corporate Governance, and Risk Management Committees are also composed entirely of independent directors.

Governance efforts have solidified investor confidence in the company, as demonstrated in the recent pricing of its $500 million drawdown last July from its $3 billion multi-issuer Euro Medium-Term Notes (EMTN) program. The issuance, which was 3.2x oversubscribed, with final demand reaching $1.6 billion, marked the company’s largest offshore bond issuance in a decade.

Sy-Coson believes that good corporate governance becomes a more effective tool when it is a shared responsibility and when members of the whole organization mutually uphold the values of fairness, accountability, integrity, transparency, and engagement with stakeholders.

A corporate governance-proactive culture within the organization builds long-term trust and business value among all stakeholders. SM directors, key officers and leaders attend corporate governance training at least annually pursuant to regulatory requirements. Such a venue is used to keep leaders and management abreast of corporate governance and environmental, social, and governance (ESG) framework developments that affect business performance and strategies.

Other than during SM’s annual stockholders’ meetings, the company communicates and engages with its key stakeholders through various communication channels such as briefings, traditional and social media, and the company website. SM employees are educated on corporate governance and ESG through the employee onboarding, training program, and awareness campaigns. Through the Orientation for New Employees of SM (ONE SM), new employees are given an overview of SM’s corporate governance framework, including the different corporate policies and its various components.

A substantial portion of the orientation is devoted to discussing SM’s core values and the Code of Ethics and highlights the roles that each can play in the development of the organization’s corporate governance culture. The Governance, Risk and Compliance Group collaborates with the Human Resources Group, Internal Audit Group and other teams to continue improving this program for all employees.

SM’s philosophy was hewn from its founder Henry “Tatang” Sy Sr.’s entrepreneurship, drive, teamwork, leadership, and, most of all, business integrity. What Tatang proved is that acting on one’s good corporate governance values can be a very good business strategy. And in this case, it was the philosophy that business growth and social growth go hand in hand.

The company is also recognized for practicing good corporate governance through the ASEAN Corporate Scorecard alongside various awards and recognition. Sy-Coson shared that the SM group’s commitment to good corporate governance provides long-term growth, sustainability and success.