- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

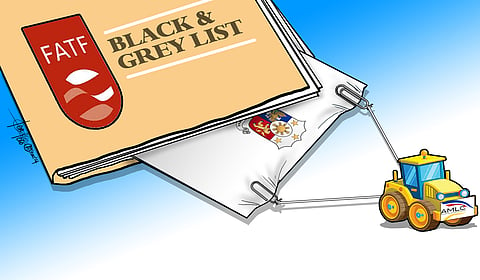

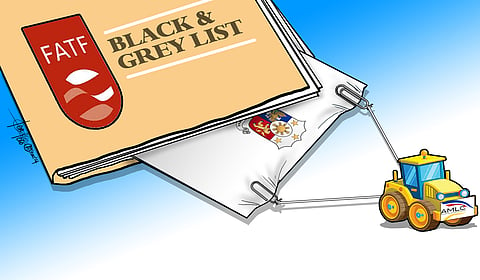

Paris-based global anti-money laundering watchdog Financial Action Task Force (FATF) has acknowledged the Philippines’ efforts to address critical issues needing resolution before the country can be taken off the so-called FATF “grey list.”

At its October 2024 plenary, FATF said it has made an initial determination that the Philippines has completed its action plan and “warrants on assessment to verify that the implementation of AML/CFT (anti-money laundering/combating the financing of terrorism) reforms has begun and is being sustained.”

A G7 (Canada, France, Germany, Italy, Japan, the UK, US, and the EU) creation, FATF, to recall, was established in 1989 to lead in the global action against money laundering, terrorist financing, and proliferation financing (the latter refers to the act of providing funds for the manufacture, acquisition, development, export, trans-shipment, brokering, stockpiling or use of nuclear, chemical or biological weapons).

To date, over 200 countries have committed to implementing FATF-set standards in coordinated global action against organized crime, corruption and terrorism.

FATF identifies countries with weak measures to combat those illicit activities in two FATF public documents — the so-called “grey list” and the “black list.”

High-risk countries subject to a FATF Call for Action, that is, a “black list,” are those with serious strategic deficiencies to counter money laundering and terrorist financing.

In the most serious cases, countries are called on to apply countermeasures to protect the international financial system from ongoing money laundering, terrorist financing and proliferation financing emanating from “black listed” countries (North Korea, Iran, and Myanman as of 25 October 2024).

Meanwhile, in the “grey list” are countries under increased monitoring, these are countries identified (e.g., the Philippines) as working with FATF to address their deficiencies in their efforts to counter money laundering, terrorist financing, and proliferation financing.

When the FATF puts a country under increased monitoring, it means the country has committed — as the Philippines has — to the speedy resolution of deficiencies within a set time frame even as it continues to be subject to increased monitoring until its delisting from the grey list.

The Philippines had been in and out of the list various times before. It was on the blacklist in 2001. In March 2003, RA 9194 was passed, amending the Anti-Money Laundering Act (AMLA), and in February 2005, the country exited FATF’s Non-Cooperative Countries and Territories (NCCT) “black list.”

The lack of a law combating terrorist financing put the Philippines on the grey list in 2010. It failed to meet its December 2011 deadline to fix that deficiency and was downgraded to the “black grey list” in February 2012.

The passage of the Terrorism Financing Prevention and Suppression Act in June 2012 and RA 10365, further amending the AMLA, got the country off the grey list but it continued to be on FATF’s watch list until June 2017 when the Casino Law was passed.

The Philippines was back on the grey list in June 2021 on the basis of FATF’s assessment that there continued to be several deficiencies that needed to be addressed to strengthen the country’s AML/CFT strategies.

In October 2024, FATF noted the government’s efforts to deal with the matter. Subsequently, the Bangko Sentral ng Pilipinas-based Anti-Money Laundering Council said the country is now closer to exiting from the grey list, paving the way for the Philippines to benefit from faster, cheaper remittances and other transactions.

Also, the FATF’s Asia Pacific Joint Group will visit the country in early 2025, marking the final steps toward the Philippine exit from the grey list.

Hopefully, the country finally makes its exit and remains delisted. Otherwise, continued inclusion in the FATF list — whether grey, black, or watch — would risk having the Philippines labeled a recidivist and even (we shudder) a global pariah.