- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

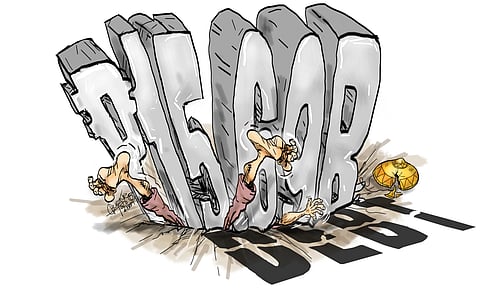

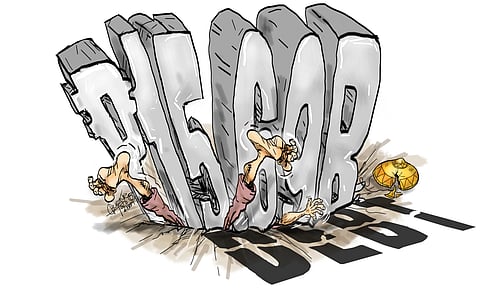

The national debt, according to reports, reached a record high P15.69 trillion in July primarily driven by the issuance of new government securities and project loans. Compared to a year ago, the debt load went up by 10.1 percent or by P1.45 trillion from the previous month.

The enormity of the debt raises crucial questions about the sustainability of the country’s fiscal policies, the long-term impacts on the economy, and the immediate repercussions on the average Filipino.

The surge in debt is not an isolated phenomenon; it stems from multiple converging factors. One key driver is the government’s need to fund its recovery from the economic impacts of the Covid-19 pandemic, particularly in relation to infrastructure projects, healthcare, and social programs.

Despite the worst of the pandemic being behind us, the economic scars have remained. Many of the loans taken out during the crisis continue to accumulate interest, compounding the national debt.

Additionally, new project loans have been sought to support infrastructure development under the Marcos administration, including big-ticket programs that the government hopes will boost the country’s long-term economic potential.

A second cause, according to the Bureau of the Treasury (BTr) is the issuance of new government securities. The Philippine government continues to rely heavily on borrowings to finance its spending plans. Government securities are essentially bonds issued to investors, both local and international, who lend money to the government in exchange for regular interest payments.

While this can be an effective way to finance long-term investments, such as infrastructure projects, it also carries inherent risks, especially if the interest rates on these securities rise or if economic conditions worsen, making it more difficult for the government to meet its debt obligations.

Finally, external shocks such as inflationary pressures and global economic slowdowns have affected the government’s borrowing. With higher global interest rates and a more uncertain economic environment, the cost of borrowing has increased, making it more expensive for the Philippines to take out loans.

Additionally, fluctuations in the peso’s exchange rate have contributed to the ballooning debt, as foreign-denominated loans become more expensive to repay when the peso weakens.

The sharp rise in debt brings with it several significant consequences, both for the economy and for the people. On a macroeconomic level, increasing debt raises concerns about the country’s ability to maintain fiscal stability. As the debt-to-GDP ratio grows, there is a risk of losing investor confidence, which could lead to higher borrowing costs in the future. A high debt burden could also crowd out essential public investments, as a greater share of government revenue will need to be allocated to debt servicing rather than development projects.

Moreover, large-scale borrowing can limit the government’s flexibility in responding to future crises. With more of the budget devoted to paying interest on debt, there may be less room for emergency spending in the event of natural disasters, economic recessions, or other unexpected events. This lack of fiscal flexibility is particularly concerning for a country like the Philippines, which is frequently exposed to typhoons, earthquakes, and other disasters that require significant government resources.

On a microeconomic level, the impact of rising debt can also be felt by ordinary citizens. As the government increases its borrowing, there is a risk that inflationary pressures may intensify, eroding the purchasing power of Filipinos. To meet its debt obligations, the government may be forced to increase taxes or cut spending on essential services such as education, healthcare, and social protection. These austerity measures could disproportionately affect the poor and vulnerable sectors of society, widening inequality and undermining efforts to reduce poverty.

To address the growing debt problem, the government needs to adopt a more comprehensive approach that balances the need for economic development with fiscal responsibility. The government must ensure that borrowed funds are used effectively, particularly in infrastructure projects and social programs. Any misallocation or corruption in the use of these funds will exacerbate the debt problem without delivering the expected benefits to the economy.

By creating a more dynamic and competitive economy, the Philippines can therefore boost its GDP, making the debt load more manageable in the long term.