- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

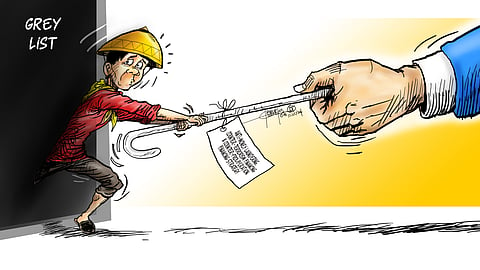

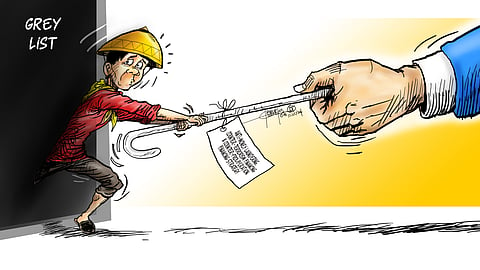

The Philippines, according to Bangko Sentral ng Pilipinas Governor Eli Remolona, is making progress towards what needs to be done by government for the country to be yanked out of the Financial Action Task Force’s “grey list.”

To recall, FATF is an intergovernmental organization comprised of seven major developed economies — Japan, Germany, France, UK, Italy, Canada and the US. This so-called Group of 7 created FATF in 2001 to check money laundering, expanding its functions in 2021 to stanch terrorism financing.

In 2000, prior to the passage of the Anti-Money Laundering Act of 2001, the Philippines, then under President Joseph Estrada, was included in the FATF’s black-listed Non-Cooperative Countries and Territories (NCCT) because it was without any basic legal Anti-Money Laundering (AML) framework.

In March 2003, RA 9194, amending the AMLA, was passed and in early 2005, the country was taken off the blacklist but was placed on FATF’s grey list in 2008, where it remained until 2012 because of the country’s lack of counter-terrorism financing (CTF) laws.

Failing to meet the deadline in implementing FATF-required regulations in 2012, the country was downgraded to the “dark grey list,” and was only pulled up to the grey list in June 2012 after the Terrorism Financing Prevention and Suppression Act was passed into law.

Republic Act 10365, further amending the AMLA, was signed into law in February 2013 and in June of that year, the country was taken off the grey list but remained on FATF’s watch list.

In July 2017 the Philippines was removed from the watch list with the enactment of RA 10927, or the Casino Law. Four years later, in June 2021, the country was dragged back into the FATF’s grey list comprised of “Jurisdictions Under Increased Monitoring.”

There’s a grey list and a black list. It’s not as serious as the latter, but remaining on the FATF’s grey list means the Philippines and Filipinos continue to be seen as possible threats to the international financial system.

Former Anti-Money Laundering Council executive director Mel Georgie Racela explains that being on such a list will see the Philippines under increased scrutiny from regulators and financial institutions and will jack up the cost of doing business with Filipinos, even as transaction processing would be delayed, impinging on the country’s efforts to attain improved credit ratings.

The Philippines has been advised to urgently come up with an action plan within a prescribed period to address identified deficiencies in countering money laundering and terrorism financing.

It must get out of the grey list by the end of this year. Otherwise, the country risks being put on the FATF’s blacklist with such dire consequences as seeing OFWs’ financial transactions obstructed.

“Remittances of OFWs will be subjected to stringent requirements and impeded by an increase in costs and could even be denied or disapproved,” said AMLC’s current executive director Matthew David.

Filipinos overseas will pay higher transaction fees to banks abroad employing due diligence on customers and spending more for checking such transactions. In the extreme, financial transactions and trade by individuals with countries in the FATF black list like North Korea, Myanmar and Iran may be disallowed.

There will also be fewer investors considering doing business in a blacklisted country. “Failure by a country to get out of the black list will have its anti-money laundering and counter-terrorism financing system viewed by the world as inadequate or insufficient,” underscored the AMLC director.

The BSP governor, who also chairs the AMLC, told participants in a recent media forum that the country will have until October this year to satisfy the requirements set by the FATF to be taken off the grey list.

The Philippines has been told to implement more effective controls for casino junkets, enhance even more cross-border detection measures at seaports and airports to identify false currency declarations, and further boost efforts to prosecute terrorist financing. “FATF will check in October and if it is satisfied, we exit in January 2025,” Remolona said.

The Philippines’ effort to get out of the FATF grey list is not just a regulatory obligation; it is a consequential move that must be made to strengthen the country’s financial integrity and global standing.

We can only hope that the government’s National Anti-Money Laundering, Counter-Terrorism Financing and Counter-Proliferation Financing Strategy (2023-2027) can complete in time all the deliverables needed to finally get the Philippines out of the grey list, lest the country is dumped along with the world’s pariahs in the dark pits.