- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

The Bangko Sentral ng Pilipinas (BSP) and several central banks in Southeast Asia moved closer to implementing instant payments and cheaper fund transfers for overseas Filipino workers (OFWs) worldwide using a single system called Nexus.

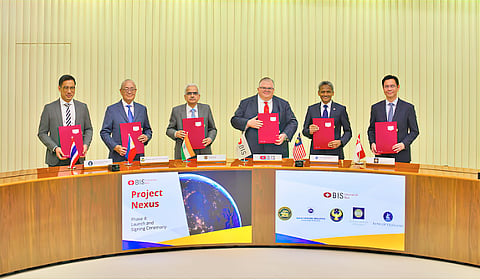

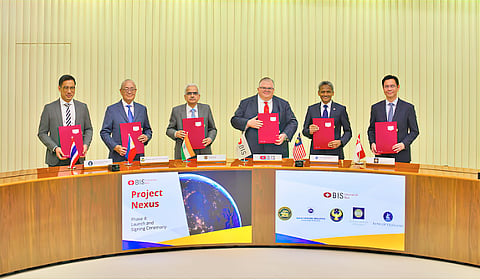

The BSP on Monday said it already completed the blueprint for the third phase of Nexus, along with the Central Bank of Malaysia, Monetary Authority of Singapore, Bank of Thailand and Bank for International Settlements (BIS).

The Reserve Bank of India and instant payment systems (IPS) operators in each country also helped complete the blueprint.

"Even with just the first wave of connected countries, Nexus has the potential to connect a market of 1.7 billion people globally, allowing them to make instant payments to each other easily and cheaply," BIS general manager Agustin Carstens said.

Nexus integrates individual systems of domestic IPS operators to make cross-border payments faster for partner countries. This means IPS operators will not need to build different connections for each country they want to serve.

In 2022, Singapore-based BIS started discussions on Nexus with the central banks for building a governance framework and exploring technologies that can enhance India’s Unified Payments Interface (UPI), the world’s largest IPS.

‘We look forward to Nexus providing overseas Filipinos with a cheaper and faster means to send money to family back home, and facilitating the globalization of Filipino small and medium scale enterprises.’

Before this, a memorandum of understanding for regional payment and connectivity was signed by the BSP and the aforementioned Southeast Asian central banks.

Since these initiatives were launched, central banks in other parts of Asia have supported Nexus. These are Brunei Darussalam Central Bank, Bank of the Lao People’s Democratic Republic and the State Bank of Vietnam.

"The BSP will continue to work with the Philippine payments industry, BIS and other interested countries towards its live implementation. We look forward to Nexus providing overseas Filipinos with a cheaper and faster means to send money to family back home, and facilitating the globalization of Filipino small and medium scale enterprises," BSP Governor Eli Remolona Jr. said.

He said the BSP aims to reduce remittance fee between countries from 5 percent to a low range of 1 to 3 percent in three years.

To proceed to the Nexus' fourth phase or live implementation, each central bank and domestic IPS must first create a Nexus Scheme Organization which will manage the global instant payment system.

The Bank Indonesia will continue to serve as a special observer and improve Nexus.

Meanwhile, the BIS will continue to provide technical advisory and facilitate cooperation between partnered central banks and domestic IPS operators.

"This is the first BIS Innovation Hub project in which central banks are moving towards a live phase together with instant payment providers. When implemented, it will greatly enhance cross-border payments in line with both the G20 cross-border payments program and our mission to develop public goods in the technology space to support central banks and improve the functioning of the financial system," Carstens said.