- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

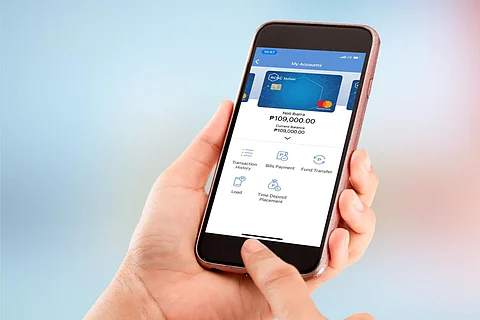

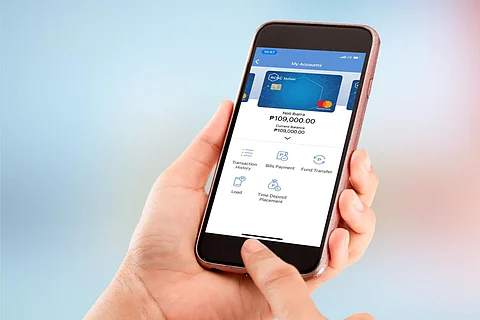

Rizal Commercial Banking Corp., or RCBC, has added a new salary loan product into its app RCBC Pulz which it continues to enhance as an all-in-one financial platform and alternative to traditional loan sharks.

RCBC said the RCBC Salary Loan now is a faster service that lends a maximum fund worth P100,000. The bank said the loan application takes a “few seconds.”

The new loan product is available to those with RCBC payroll accounts and payable up to 12 months.

Loan proceeds are automatically directed to the clients’ RCBC payroll accounts. The monthly loan payments are also automatically debited on their accounts.

With the product’s friendly terms, RCBC said it aims to prevent financial burden on Filipinos from unjust informal lenders.

Away from sharks

“We want to shift borrowing from informal lenders, such as ATM sangla, to RCBC as a proper financial channel. This way, the employees do not need to pay for exorbitant rates provided by loan sharks,” Arniel Ong, RCBC head for credit cards and personal loans, said.

“ATM sangla (pawning) is a practice where the employee gives his/her ATM Card as a guarantee to the person he/she is borrowing from,” he explained.

Lito Villanueva, RCBC chief innovation and inclusion officer, had said the bank will be introducing several digital products and services in the first half of the year.

“Our battle cry is to go for more. We have lined up exciting innovations for our customers,” he said.