- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

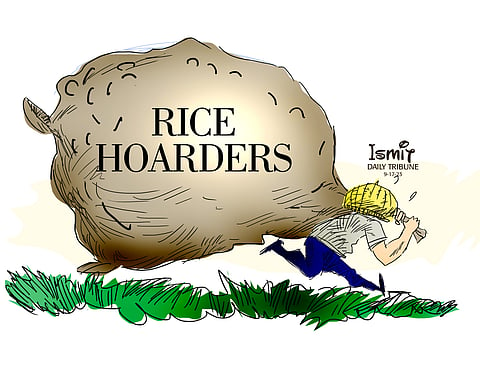

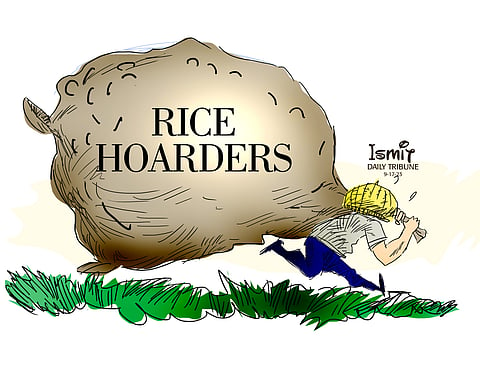

Members of the rice cartel are starting to feel uneasy over steps being taken to stabilize the market after they were caught flatfooted by the price cap.

President Ferdinand "Bongbong" Marcos Jr. recently signed Executive Order 39, which mandated the price of regular milled rice at P41 per kilo while well-milled rice was fixed at P45 per kilo.

The strategy is to maintain the low price while the market receives a steady stream of rice from imports and the coming harvest.

In effect, all the hoarded rice would be flushed out at the government-mandated price levels or lower.

After the Rice Tariffication Law took effect, a well-organized lobby was launched to either rescind or amend the measure and hand back the importation monopoly to the National Food Administration.

With the purchase of rice centralized in the NFA, the cartel, which had the agency's officials on payola, was able to control the market effectively.

Prices were let loose by creating distortions such as an artificial shortage, which exploited India's announcement that it was restricting rice exports.

India's move was of little consequence since the country imports 90 percent of the staple grain from Vietnam and Thailand.

Even if import prices are pushed higher, the influx of local rice, with the harvest season coming, will drive down costs.

The lobby included a former Department of Agriculture official who blamed the high prices on the Rice Tariffication Law and insisted that the old system, where the NFA had sole authority to import, was better.

Under EO 39, the NFA's mandate was restricted to purchasing from local farmers.

The official claimed the RTL handed the rice industry to the cartel on a silver platter. NFA's monopoly had benefited only the cartel and the officials in its pocket.

The cartel used to kill in tandem with the NFA when prices on the global market were high, as the percentages were higher.

As a result of the price cap, Speaker Martin Romualdez said massive cancellations of orders from local rice traders resulted in the world market quotations trending downward.

According to United States-based Market Insider, the price of rice in the world market decreased by 21 percent, from $384 per metric ton last July to $332.4 per MT this month.

"It is proven that EO 39 set commendable results not only in our country but in the world as well," Romualdez said in a statement.

Based on Department of Agriculture data, the country's rice stock is sufficient to last for months.

The data showed 10.15 million metric tons of buffer stock for the rest of the year, with a 2.53-MMT surplus from the previous harvest and 7.2 MMT as the expected yield from local production. Only 410,000 MT comes from imports.

The stock would be more than enough to cover the current demand of 7.76 MMT during this harvest round and will yield an ending stock of 2.39 MM that will last up to 64 days, according to DA's report.

Romualdez said massive cancellations by rice traders and importers in the Philippines resulted in the world market's deluge of available rice stocks.

The Philippines was recently reported by the United States Department of Agriculture to have overtaken China as the biggest rice importer worldwide.

"It is obvious that the upsurge in prices was artificial because our inspections showed that rice stocks were being held in warehouses," Romualdez said.

He recently led an inspection of the most extensive rice warehouses in Luzon that resulted in the discovery of huge stocks suspected to have been kept from the market.

The price cap will hold as local harvests start flooding the market. By then, the hoarders will be forced to sell at a loss, thus increasing availability.

Then another law will take over — that of supply and demand — that will further lower the price of rice.