- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

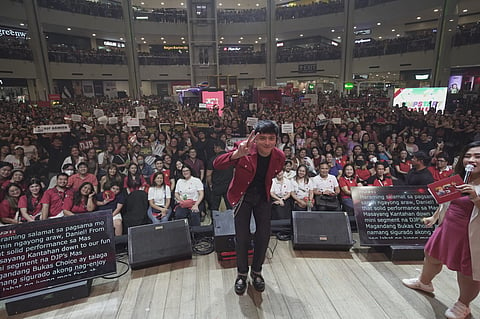

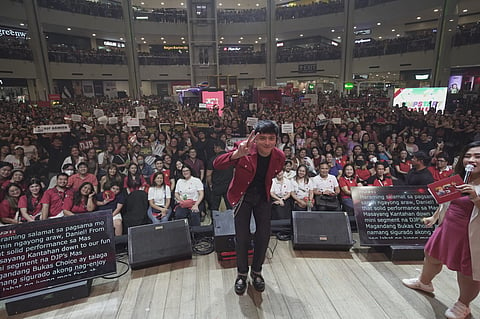

The Bank of the Philippine Islands is strengthening its commitment to financial inclusion by boosting its digitalization efforts. The bank recently launched the "Barangay Mas Magandang Bukas" campaign to help Filipinos achieve their financial goals through affordable digital banking products and services, with particular aim on the underbanked and underserved segments of the population.

The campaign is also aligned with BPI's strategic thrust toward greater financial inclusion in support of its mission of building a better Philippines — one family, one community at a time.

"We want to provide financial solutions that will enable Filipinos to perform daily transactions such as paying bills, borrowing and sending money and saving more conveniently and effectively. We at BPI remain committed to supporting and empowering Filipino communities so they can attain financial success and realize a brighter future — a Mas magandang bukas para sa lahat," said BPI consumer banking head Ginbee Go.

BPI has introduced PeraWise bundles, which include PeraWise Savings, PeraWise Loans and PeraWise Digital Banking.

With PeraWise Savings, clients can open a #SaveUp Account with Free Life Insurance of up to 100,000 coverage, plus a special package of Personal Accident Insurance at P335 and Pamilya Protect Insurance for as low as P500.

With PeraWise Loans, clients can avail of affordable monthly amortizations and insurance protection through MyBahay and MyKotse Auto Loans.