- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

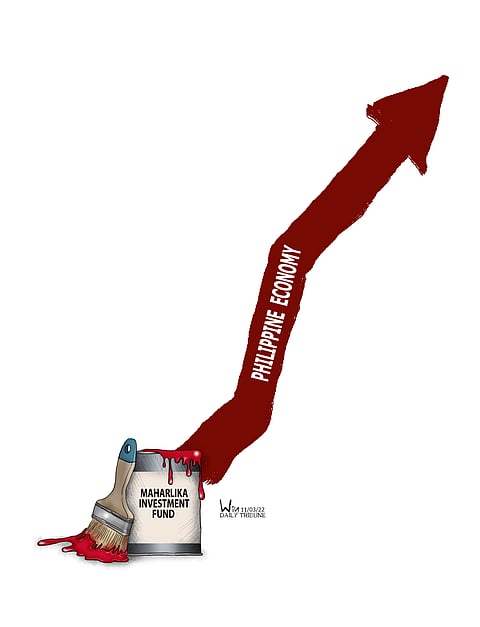

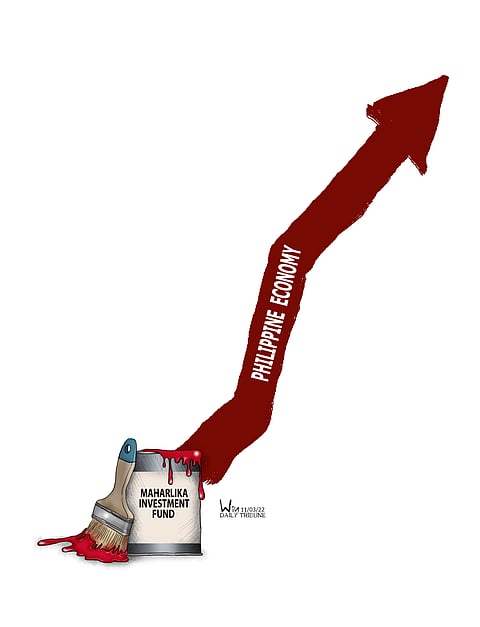

The brainchild of Speaker Martin Romualdez and Ilocos Norte Representative Ferdinand Alexander Marcos, a measure seeking the creation of a sovereign wealth fund or the Maharlika Investment Fund, is moving at a quantum speed at the House of Representatives proving the proposal is well-timed.

The support that the bill has been receiving from legislators confounded the noise from the minority including the militants who oppose the measure just to hit the papers.

Among the criticisms were the growing budget deficit and the trillions of pesos worth of debt.

Noisemakers of different hues in Congress apparently have not read the provisions of the proposal since these are the fiscal problems that the creation of the SWF seeks to cure.

The bill is getting a nudge from what Finance Secretary Benjamin Diokno referred to as the imprimatur of President Ferdinand "Bongbong" Marcos.

The makeup of the fund is revealed in details of the bill, which is now at the amendments stage in the House committee on banks and financial intermediaries.

Senior deputy majority leader Rep. Sandro Marcos said the Philippines wanted to catch up with developing countries that have used wealth funds to generate revenues.

He cited the Indonesian fund which grew from $1 billion to about $24 billion in just over one year.

The seed money for the Philippine proposal will be about P200 billion. The Maharlika fund is now under development by an inter-agency working group composed of the Department of Finance, the Department of Budget and Management, the National Economic and Development Authority, and government financial institutions.

The startup money will be sourced from pension funds Government Service Insurance System and Social Security System. State-owned financial institutions Land Bank of the Philippines and Development Bank of the Philippines will also contribute to the fund.

The creation of the wealth fund is logical from the fiscal point of view since surplus government wealth accumulates as the economy grows.

Revenue-earning institutions then pool the money in the fund to compete in capital-intensive but high-return projects in infrastructure, industries, and other growth sectors.

A primary reason for the economy being restricted in its potential is the lack of capital which many projects had to source from foreign investors if not from debts.

The creation of the fund will create a preferable option where the nation controls the investments and earn from them likewise.

Romualdez said the Maharlika fund would "improve investment opportunities, promote productivity-enhancing investments and ensure that the Philippines becomes an investment destination".

It will be instrumental in hitting the Prosperity Agenda of BBM.

The biggest advantage of the Maharlika Fund is that its benefits immediately would trickle down to Filipinos who are GSIS and SSS members or practically the entire workforce.

Albay Rep. Joey Salceda, head of the House technical working group, said safeguards were introduced in the measure to ensure its proper use which are three layers of audit through internal and external accounting and a separate check from the Commission on Audit and four layers of good corporate governance through the board of directors, the advisory body, the risk management unit, and the congressional oversight committee.

Invest big, earn big, that's how industrialized nations have made their mark.