- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

The uncertain global environmental risks on the financial markets will push the Monetary Board to hike interest rates between 25 and 50 bps (basis points) as economic conditions remain tight and financial stability remains unsettled.

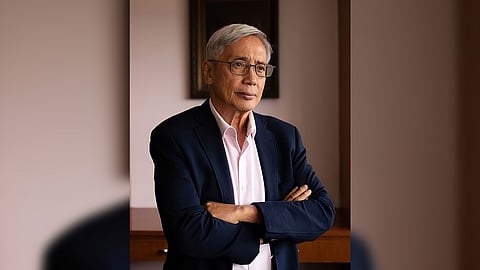

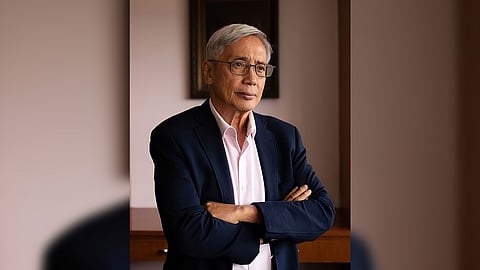

Bangko Sentral ng Pilipinas Governor Felipe Medalla said on Friday that MB members are still undecided on the exact key rate hike.

"I cannot speak for the rest of the (Monetary Board), but I think the board members will probably be split between whether doing 25 or 50 (basis points)," Medalla said in an interview with Bloomberg TV.

Medalla said, the seven-member monetary board, will review the BSP's interest rate settings on 15 December in its last policy meeting of the year.

In the same interview, Medalla reiterated his forecast that the United States Federal Reserve would scale back its interest rate hikes.

Medalla told the reporters on Tuesday, 29 November that the BSP might pause the policy tightening next year if there are no significant shocks.

Based on his "best-case scenario," Medalla said that the Fed might take a "pause" by the first quarter of the next year.

However, in the same Bloomberg TV interview, he said that key rates might peak in the first half of 2023.

The BSP has increased its benchmark interest rates by a cumulative 300 basis points since May to help curb inflation in the country.