- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

Bangko Sentral ng Pilipinas officials will meet on 17 November to decíde on policy vis-a-vis the US Federal Reserve's hiking of interest rates to 0.75 percentage points.

A higher Fed funds rate means higher loan interest rates, which can reduce demand among banks and other financial institutions to borrow money. The banks pass on these higher borrowing costs by raising the rates they charge for consumer loans.

The BSP will match the Fed's rate hike.

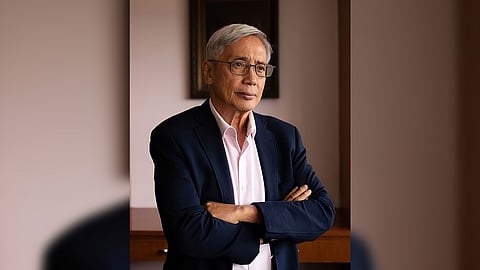

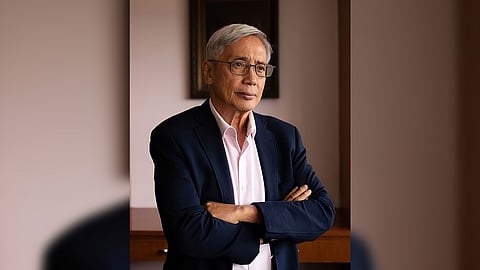

"The BSP deems it necessary to maintain the interest rate differential prevailing before the most recent Fed rate hike, in line with its price stability mandate and the need to temper any impact on the Philippines' exchange rate," BSP Gov. Felipe Medalla told reporters on 3 November.

Medalla added that by matching the Fed's rate hike, "the BSP reiterates its strong commitment to its mandate of maintaining price stability by aggressively dealing with inflationary pressures stemming from local and global factors."