- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

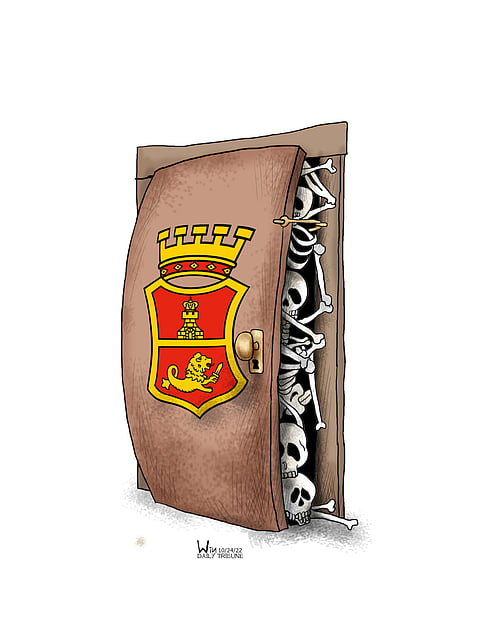

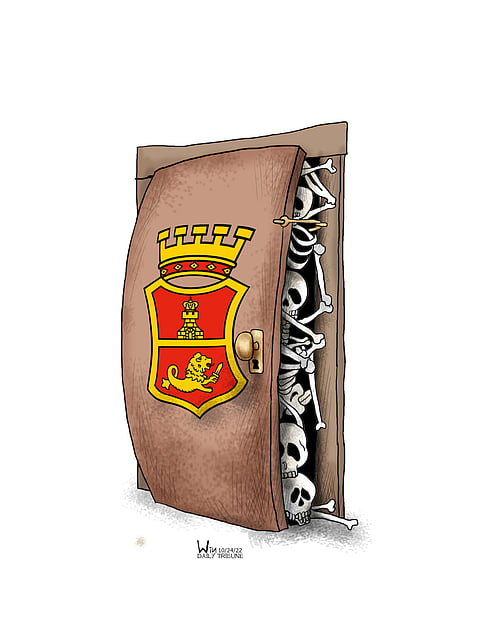

San Miguel Corp. has inadvertently opened a narrow slit into its financial state as it engaged consumer groups in an effort to arm-twist the Energy Regulatory Commission into allowing a revision of the fixed terms in its straight pricing contract with Manila Electric Company.

Questions are being raised regarding the health of its unit SMC Global Power amid indications that it is highly leveraged, a condition that permeates throughout the mammoth conglomerate.

Suspicions about its liquidity were raised by the oppositors of the SMC Global Power petition for a P4.80-per-kilowatt-hour increase in the charges of its Ilijan natural gas and Sual coal plants that the ERC recently dismissed.

SMC President and CEO Ramon Ang said that "we have never been more confident of the fundamental strength of our businesses." However, independent groups are skeptical due to the ambivalent statements of SMC.

Without presenting proof, SMC claimed that it lost P15 billion over the fixed-price power supply agreements which it is now trying to free itself from.

After attempting and failing to pass on to consumers the burden from its losses due to bum decisions, "SMC is now saying that it will have P30 billion in windfall annually in the next two years as its amortizations for its Ilijan and Sual power plants are completed," consumer coalition Power for People said.

"What is the truth? Did SMC lie about its losses?" P4P convenor Gerry Arances asked. "If it did lie, why? Or is SMC lying right now about its cash flow? If it's not telling the truth about its cash flow, then there is no reason for it to renege on the PSA it signed in 2019," Arances added.

The actuation so far of SMC showed its lack of transparency and its alleged tendency to deceive concerning its recent petition to hike electricity rates.

An example of such a bare-faced lie propagated following the ERC rejection of the price adjustment petition was that the Regulatory Operations Service of the quasi-judicial body sided with the SMC motion to raise electricity rates set in the 2019 power supply agreement despite SMC's commitment to delivering energy at a fixed price.

"Since the ERC decided to deny the rate increase petition, we have noted claims popping up in the media that the decision was made against the findings of the ROS. The ERC said the claimed figures of SMC and computations of ROS were not aligned in many ways," Arances pointed out.

The consumer advocacy group said SMC, as the parent of the largest generation companies in the country and as a publicly-held corporation, should be truthful about its public pronouncements.

Being opaque and its intent of not honoring the provisions of the PSAs it holds are enough reasons to bar SMC Global Power from all power deal auctions, it added.

SMC's stated intention to join further PSA biddings has revealed that its real goal in its ERC application was to discard its existing deal.

"Right now, SMC seems unable or unwilling to uphold its commitments," Arances said. SMC should not participate in future PSA biddings, at least until it comes out with the whole truth, according to Arances.

ERC must compel the applicant for a rate increase to reveal its true financial health since it anchored the petition for a rate increase on its claimed losses. Transparency for SMC Global Power, a publicly-listed conglomerate, is not an option but a must.