- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

Compared with other parts of the country, Metro Manila remains to have stable and relatively low power bills, mainly as a result of the straight energy pricing scheme that does not allow fuel and foreign exchange risks to be passed on to consumers.

In the other pricing option, a two-part tariff, consumers pay for higher fixed capital costs in cases of lower utilization factors and higher variable costs in the event of spikes in fuels and exchange rates.

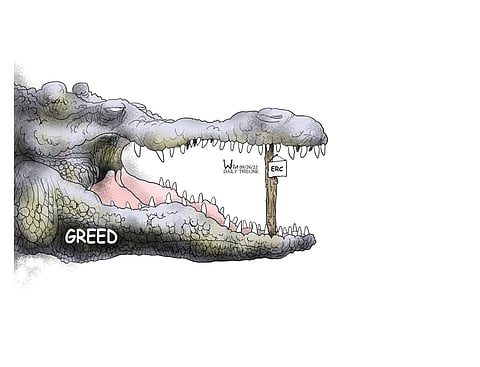

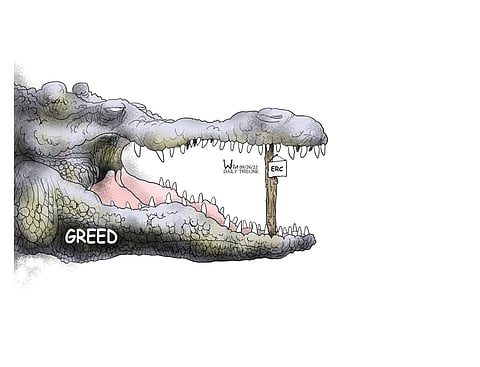

The use of the second method shields generation companies, which insist on operating fossil fuel power plants, from loss, and thus allows them to continue to rake in profits.

On 26 December 2019, power distributor Meralco held a competitive selection process for three power supply agreements for baseload power supply, which were won by South Premiere Power Corporation, San Miguel Energy Corporation and AC Energy Corporation.

All three contracts use the straight pricing scheme.

The first two generation companies are owned by business giant San Miguel Corp., while ACEN is owned by a venture of Phinma and property conglomerate Ayala Corp.

What catches the attention of stakeholders in the industry is that while the units of SMC Global Power — SPPC and SMEC — have filed petitions for rate adjustments, claiming that it is piling losses of P15 billion as a result of rising fuel prices, ACEN was not complaining.

ACEN has two PSAs with a straight energy price, one for a coal plant and another for combined coal and two solar farms,

while the Lopez Group's First Gen Hydro Power Corporation has one PSA with a straight energy price buying from geothermal power plants.

Neither has claimed nor tried to recover its losses.

Consumer groups also complained that SMC Global Power never showed proof of their claimed losses, and that its threat to pull out from the PSAs with Meralco was intended to obtain a better deal.

Straight energy pricing protects consumers from shouldering pass-on fuel and currency exchange risks, which is common among extremely volatile fossil fuels.

To prevent generating companies from taking advantage of consumers, a straight pricing method should be mandated in all power supply agreements, consumer advocates under the Power for Consumer Coalition stated.

Currently, Meralco has 1,700 MW with straight energy pricing: A third of its total contracted capacity with power rates from those staying well below P5 per kilowatt hour, and about 210 MW taken from solar and geothermal sources.

The straight pricing scheme also favors the eventual shift to renewable energy, since such a source of energy does not have a fuel component that is the source of volatility in electricity prices.

Consumers are eventual beneficiaries in terms of stable electricity prices.