- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

The bellwether Philippine Stock Exchange index dropped by 16.61 points to 6,676.04 on the first trading day of the week as investors reacted to the weakening peso, which is moving towards an all-time low, while national debt rose to a record high.

"The peso remains at 56 levels but it is now trying to breach the 57 levels amid the aggressive stance of the Federal Reserve," Philstocks Financial Inc. assistant manager for research and online engagement Claire Alviar said in a text message.

Meanwhile, Luis Limlingan, Head of Sales at the Regina Capital Development Corp., said the market performance was also affected by "some overhang as the US sold down on Friday, with fears that the Fed would stay aggressive in hiking rates to combat inflation."

Thus, some investors were on the sidelines, which was evident due to the weak net value turnover recorded at P3.1 billion — lower than the year-to-date average of P6.30 billion, as investors await the release of August's inflation rate.

Investors stay cautious

AB Capital Securities said investors remain cautious ahead of the Philippine August inflation data set to come out today. BSP forecasts inflation to fall within 5.9 percent to 6.7 percent.

Upon closing, banks and services posted gains and advanced by 1.11 percent and 0.10 percent, respectively. On the other hand, properties lost the most as it dropped 0.73 percent.

BDO Unibank Inc. was the top gainer after it gained 1.72 percent while ACEN Corporation was the biggest loser after it dropped by 4.71 percent.

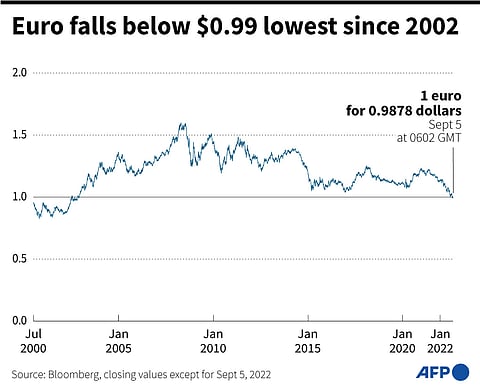

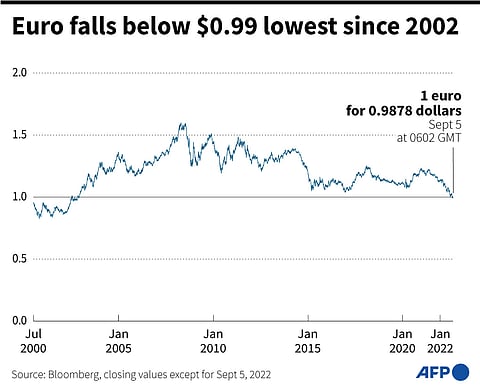

European markets on Monday tumbled and the euro hit a fresh 20-year low on growing fears about an energy crisis after Russia said it would not restart gas flows to the continent, while traders are also preparing for another interest rate hike this week.