- NEWS

- the EDIT

- COMMENTARY

- BUSINESS

- LIFE

- SHOW

- ACTION

- GLOBAL GOALS

- SNAPS

- DYARYO TIRADA

- MORE

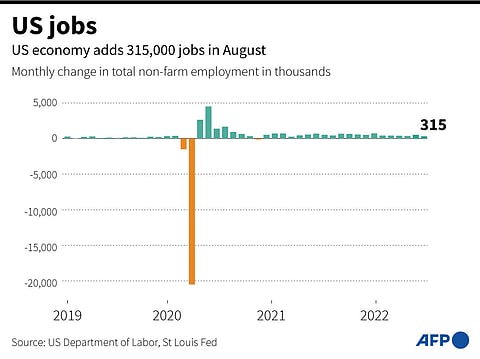

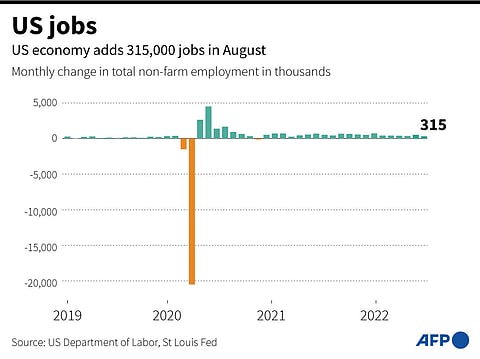

Washington, United States (AFP) — American employers slowed the pace of hiring in August after the surprising surge in the prior month and the jobless rate edged up, according to government data released on Friday, which could offer the central bank some relief that its inflation-fighting efforts are working.

The Federal Reserve is paying close attention to the progression of the hot job market, looking for signs of easing as it tries to cool the economy with steep interest rate hikes to tamp down inflation which has reached a 40-year high.

While the data showed wages continued to rise, the unemployment rate ticked up as more workers joined the labor force, a welcome development that could allow the Fed to opt for a smaller move later this month after two consecutive super-sized rate increases.

President Joe Biden, who has been riding a wave of legislative and economic victories, cheered the latest report.

"More great news: Our jobs market remains strong. Even more Americans are coming back to work," Biden tweeted.

Even with the slowing pace, the job gains bring employment above the pre-pandemic level, the Labor Department said in the closely watched monthly report.

Fed maintains view

The US economy added 315,000 jobs last month, the report said, which was in line with what economists were expecting after 526,000 hires in July.

The unemployment rate moved back up to 3.7 percent, after dipping to 3.5 percent in the prior month, according to the data. And the labor force participation rate rose three-tenths to 62.4 percent.

But wages continued to climb in August, as average hourly earnings rose another 10 cents, or 0.3 percent, to $32.36 — slower from the pace in recent months. Over the past 12 months, worker pay has increased by 5.2 percent.

Continued upward pressure is a cause for concern since the Fed fears it could lead to a wage-price spiral and push inflation higher.

Surging inflation, exacerbated by high energy prices due to Russia's war in Ukraine, as well as supply chain struggles and Covid-lockdowns in China, has prompted the Fed to raise the benchmark borrowing rate four times this year, including giant 0.75 percentage point increases in June and July.